INSIGHTS • AUG 2025

Drug shortages: The causes and solutions in clinical supplies

Drug shortages have become a persistent challenge in the pharmaceutical industry. For clinical trial sponsors, an unreliable and inconsistent supply of drugs can jeopardise both trial outcomes and the health of patients. However, partnering with experts in clinical logistics can help ensure access to steady supplies of products, reducing the risk of trial discontinuation and improving the quality of patient care.

Drug shortages have been a major concern in in the clinical supply chain for more than a decade, with the COVID-19 pandemic worsening the situation considerably. Yet the issue has become particularly acute more recently due to a combination of geopolitical disruption, continuing production bottlenecks, and surging demand.

Different factors are influencing demand. For example, the fundamental reason behind the significant scarcity of GLP-1 agonist medications was due to their effectiveness at managing obesity and weight loss. However, the challenge of sourcing extends to other classes of drugs, with scarcity also affecting anaesthetics and oncology medications.

Medication scarcity has an especially detrimental effect on clinical trials for several reasons. The majority of late-stage clinical trials rely on comparisons between new investigational medical products (IMP) and standard-of-care comparators. If there are insufficient quantities of comparator drugs, the integrity of the trial could be undermined by delays and non-compliance with data points missed.

However, the consequences to patients can be even more severe. “The impact of drug shortages is worse patient care, treatment delays, and the use of less effective or risky alternatives,” explains Zayheda Khan, commercial officer and managing director of Oximio UK, a specialist provider of clinical logistics. Clinical trial sponsors and contract research organisations also need to consider the ethics of possibly providing inconsistent treatment to patients with life-threatening conditions such as cancer and rare diseases.

Overcoming challenges with drug shortages requires a coordinated strategy that has sufficient flexibility to adapt as circumstances change and new demands arise. One of the first steps is identifying where the problems occur in order to develop a solution.

Complex regulations and quality control

Among the leading causes of ongoing drug shortages is manufacturing disruption, which is often linked to quality concerns. In 2024, a US House Ways and Means Committee hearing identified low quality manufacturing as one of the main causes of chronic drug shortages.

Alongside this, failing quality control inspections and delays in obtaining regulatory compliance have intensified existing bottlenecks in the supply chain. Industry professionals in Europe have similar concerns, with a survey of EU pharmacists naming disruption or suspension of the manufacturing process as one of the most common causes of drug shortages.

“A shortage of drugs can be caused by manufacturing issues,” explains Khan. “So, that could be the quality issues as part of the manufacturing process, such as GMP violations.”

The good manufacturing practice (GMP) framework ensures pharmaceutical products meet high standards for quality and safety across all production systems, preventing substandard, and fraudulent medicines from entering circulation.

For pharmaceutical manufacturers, meeting these standards is imperative as many countries will only accept the import of medicines that have been produced to GMP guidelines. A failed inspection can halt production or result in a product recall.

GMP inspections are carried out by national and regional health regulatory authorities such as the US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Medicines and Healthcare products Regulatory Agency (MHRA). For manufacturers, especially those operating internationally, meeting these standards can be complicated due to variations in GMP across regions.

A notable example of a manufacturer falling foul of an FDA inspection took place in India in 2023, which led to production being halted and resulted in shortages of the chemotherapy medications carboplatin and cisplatin. In some cases, the cost and difficulty of compliance may mean manufacturers voluntarily exit the market, further exacerbating supply scarcity.

Distribution and shipping delays

Even when production runs smoothly and quality control is met, transport and distribution inefficiencies can threaten the availability of clinical supplies. Geopolitical instability – from events such as the wars in Ukraine and the Middle East – has led to shipping lines being rerouted, resulting in delayed or cancelled deliveries. Additionally, customs complexities caused by Brexit have led to delays and bottlenecks at border checkpoints entering and exiting the UK.

Delays are especially hazardous for temperature-sensitive medications such as intravenous oncology treatments. For instance, a shortage of intravenous etoposide in between 2018 and 2020 was associated with an increase in hospitalisation and decrease in survival rates among patients with extensive-stage small-cell lung cancer.

Drugs such as these require cold-chain logistics networks to keep them at a certain temperature during transport and storage. Any break in the cold chain – whether due to inadequate packaging, power outages, poor monitoring or mislabelled packaging – can render the entire shipment unusable as the drugs become either ineffective or hazardous. The waste and spoilage caused by cold chain failure not only increases costs but also exacerbates existing shortages.

Further complicating matters is the widespread use of just-in-time (JIT) logistics. This lean model of operation is designed to reduce overheads, with little to no room for error. In terms of extra time or back-up stock, any delay in transport or production can lead to undersupply. This can then compromise the validity of a trial if patients are unable to adhere to dosing schedules.

Limited and low availability of medical products

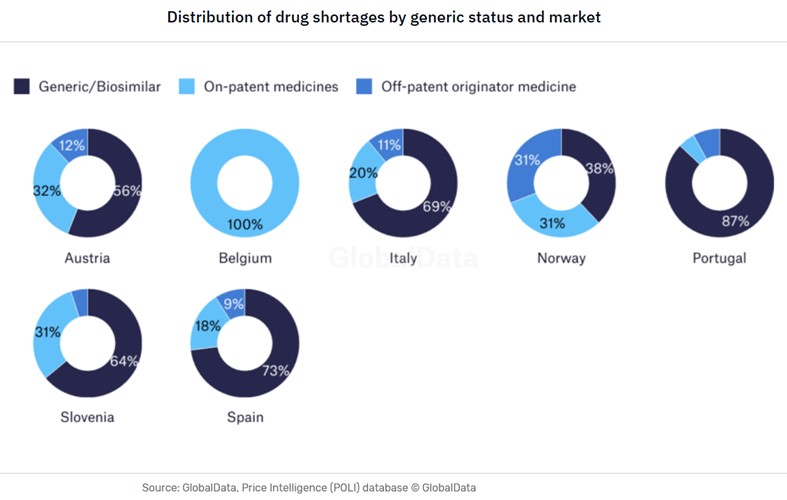

The types of drug shortages can vary from country to country – even in closely aligned markets such as within Europe, as demonstrated by the GlobalData analysis below regarding the shortages of generics in the domestic markets.

Another critical vulnerability lies at the very start of the clinical supply chain with the production of active pharmaceutical ingredients (APIs). According to GlobalData’s Strategic Intelligence Technology China Tech 2025, the US sources 80% of its API imports from China and India. These countries also produce the key starting materials (KSM) for between 90% and 95% of US generic sterile injectables (GSI), which include many oncology treatments.

The small number of source countries leaves clinical supplies considerably exposed to shifting national policies, import controls, diplomatic tensions, and geopolitical risk. This is exemplified by the sweeping US tariffs that went into effect on 1 August 2025, which put a 25% tariff on imports from India. While a US-China trade deal has yet to materialise.

Re-shoring manufacturing

In addition to the tariffs, the US is implementing other policies aimed at re-shoring pharmaceutical production and encouraging supplier diversification. The US BIOSECURE Act will make it mandatory for US pharmaceutical and biotech companies that receive federal funding to end relationships with five Chinese biotech manufacturers.

This proposed legislation puts significant financial and political pressure on pharma companies to switch to domestic manufacture of APIs and KSMs. Europe is following a similar trajectory with some key differences. Two initiatives in France and one in Austria are incentivising regional API production through government funding and support.

However, such a substantial supply chain adjustment takes time. Many manufacturers in the US, EU, and UK do not have the capacity or technology to immediately take over production from India and China. Factories need to be retrofitted to produce APIs in a GMP-compliant manner, and local workforces may need training.

In the interim, shortages are inevitable. Some pharma companies may choose to exit the market instead of taking on this additional cost burden of redesigning existing facilities, further contributing to the contraction of output.

Production capacity and strategic decisions

Even the facilities designed and equipped to produce KSMs and APIs can have limited production output. The physical constraints of smaller manufacturing facilities can restrict the ability to scale up quickly, and high production costs mean some larger manufacturers may choose not to.

“Sometimes, the smaller manufacturing facilities don’t have the capacity to actually do the runs fast enough,” says Khan. “And then some of the bigger organisations won’t do the small manufacturing runs because it’s not worth their while to make something that might produce 1,000 tablets.”

Manufacturers not only have to make strategic decisions about whether to do a production run in the first place, but also the drug class that should take priority based on projected margins and the effect on the company’s market position.

“Do you actually then utilise your manufacturing line for paracetamol, or do you utilise it for oncology medication? This is more of an ethical dilemma,” says Khan. “Your volume might be less, but the cost will be more,” she adds. “But you know you’ll get 100,000 tablets of paracetamol versus about 1,000 packs of an oncology drug.”

For niche or low-volume medications, there are often few incentives to continue production. The consequence is that it is ultimately patients that are left without treatments.

Inflation and cost pressures

Macroeconomic factors also play a role in drug shortages. Rising prices for raw materials, energy, labour, and compliance can restrict profit margins. In some countries, price caps and reimbursement costs can reduce profit margins even further, placing additional financial strain on manufacturers. When faced with thin margins, pharma companies might delay production, reduce batch quantities, or even cease manufacture entirely.

These cost pressures can lead to market consolidation, reducing an already small number of suppliers even further. Any merger itself can be costly as the acquiring company may have to reapply for licences previously held by the smaller company, resulting in products being taken off the market while the issue is resolved.

The importance of strategic partnerships in clinical logistics

With so few of the causes of drug scarcity within their control, clinical trial sponsors and CROs have little choice but to accept that the risks of medicine scarcity are ever-present. However, it is possible to take steps to mitigate the risks by partnering with specialists in clinical logistics that understand the nuances of pharma supply chains.

Navigating the patchwork of global regulations is a key challenge in logistics. Working with clinical logistics specialists can help reassure sponsors and CROs that all procurement activities will comply with legal and regulatory requirements and certifications regardless of regional and geographic variations.

Accurate labelling is vital for sponsors and CROs to identify the drugs that are investigational, placebo or comparators to ensure that patients in different control groups receive their designated medication. The use of correct labels to confirm product ingredients, dosage instructions, and explicitly state warnings is also essential for compliance with trial regulations.

In addition, labelling reduces the potential for delays that could lead to the discontinuation of a trial. Oximio covers all aspects of the procurement and supply chain process, ranging from inventory control and data integrity to administration tasks and labelling.

Reducing customs delays

By leveraging a network of customs or bonded warehouses – where goods are treated as being outside of the customs territory – trial sponsors that partner with Oximio can defer the payment of import taxes and fees. This approach enables sponsors to improve their cashflow and minimise burden of administration and paperwork.

To further safeguard consignments of clinical supplies against customs delays, Oximio offers full sets of documentation, including Contract of Affreightment (CoA), Certificate of Conformity (CoC), and Material Safety Data Sheet (MSDS) for each product.

Effective distribution and cold chain logistics

Logistics partners that understand how to integrate buffers of surplus stock and extra time in schedules can provide critical support against unforeseen events such as natural disasters and geopolitical conflicts that may lead to delays or abandoned cargo altogether. Oximio typically builds an extra third more time into logistics schedules to accommodate for potential.

“When determining manufacturing timetabling, if they say three months, we’ll say three to four months,” explains Khan.

Maintaining the safety and integrity of temperature-controlled drugs requires cold-chain storage, transport and packaging, as well as temperature performance monitoring. Cold-chain logistics helps prevent medicines from expiring, which reduces the risk of shortages and products going to waste.

Oximio can protect the safety of sample products by offering depots and warehouses. Other distribution and storage facilities available can support the four temperature requirements of ambient, refrigerated, freezer, and ultra-low freezer.

Efficient drug sourcing and procurement

A clinical trials logistics partner will often have specialist industry knowledge to overcome the challenge of limited supply by offering centralised and localised sourcing. Effective comparator sourcing involves selecting suitable suppliers based on cost, quality, reliability, geography, and regulatory requirements.

Oximio has extensive experience in handling vendor management by nurturing and maintaining positive relationships with suppliers to foster long-term collaborations. Alongside this, we also have a comparator sourcing team that scans the market for product availability with the aim of obtaining the best prices for clients within optimum lead times.

The causes of drug shortages – manufacturing issues, quality control issues, shipping delays, complicated regulations and re-shoring – are diverse, interconnected, and cannot be resolved overnight. However, through planning, diversifying sources and partnering with clinical trial logistics specialists can go a long way in ensuring a steady flow of medications for clinical trials.

Despite rising costs, Oximio’s teams of experienced negotiators regularly secure competitive pricing and favourable terms for a variety of products.

With more than two decades of experience in the clinical supply logistics, we can offer in-depth research, extensive networks, and expert sourcing capabilities. This all provides the capabilities to help our partners source high-value pharma supplies safely and consistently, successfully navigating multiple areas of potential disruption.