Drug shortages: The causes and solutions in clinical supplies

Drug shortages have become a persistent challenge in the pharmaceutical industry. For clinical trial sponsors, an unreliable and inconsistent supply of drugs can jeopardise both trial outcomes and the health of patients. However, partnering with experts in clinical logistics can help ensure access to steady supplies of products, reducing the risk of trial discontinuation and improving the quality of patient care.

Drug shortages have been a major concern in in the clinical supply chain for more than a decade, with the COVID-19 pandemic worsening the situation considerably. Yet the issue has become particularly acute more recently due to a combination of geopolitical disruption, continuing production bottlenecks, and surging demand.

Different factors are influencing demand. For example, the fundamental reason behind the significant scarcity of GLP-1 agonist medications was due to their effectiveness at managing obesity and weight loss. However, the challenge of sourcing extends to other classes of drugs, with scarcity also affecting anaesthetics and oncology medications.

Medication scarcity has an especially detrimental effect on clinical trials for several reasons. The majority of late-stage clinical trials rely on comparisons between new investigational medical products (IMP) and standard-of-care comparators. If there are insufficient quantities of comparator drugs, the integrity of the trial could be undermined by delays and non-compliance with data points missed.

However, the consequences to patients can be even more severe. “The impact of drug shortages is worse patient care, treatment delays, and the use of less effective or risky alternatives,” explains Zayheda Khan, commercial officer and managing director of Oximio UK, a specialist provider of clinical logistics. Clinical trial sponsors and contract research organisations also need to consider the ethics of possibly providing inconsistent treatment to patients with life-threatening conditions such as cancer and rare diseases.

Overcoming challenges with drug shortages requires a coordinated strategy that has sufficient flexibility to adapt as circumstances change and new demands arise. One of the first steps is identifying where the problems occur in order to develop a solution.

Complex regulations and quality control

Among the leading causes of ongoing drug shortages is manufacturing disruption, which is often linked to quality concerns. In 2024, a US House Ways and Means Committee hearing identified low quality manufacturing as one of the main causes of chronic drug shortages.

Alongside this, failing quality control inspections and delays in obtaining regulatory compliance have intensified existing bottlenecks in the supply chain. Industry professionals in Europe have similar concerns, with a survey of EU pharmacists naming disruption or suspension of the manufacturing process as one of the most common causes of drug shortages.

“A shortage of drugs can be caused by manufacturing issues,” explains Khan. “So, that could be the quality issues as part of the manufacturing process, such as GMP violations.”

The good manufacturing practice (GMP) framework ensures pharmaceutical products meet high standards for quality and safety across all production systems, preventing substandard, and fraudulent medicines from entering circulation.

For pharmaceutical manufacturers, meeting these standards is imperative as many countries will only accept the import of medicines that have been produced to GMP guidelines. A failed inspection can halt production or result in a product recall.

GMP inspections are carried out by national and regional health regulatory authorities such as the US Food and Drug Administration (FDA), European Medicines Agency (EMA), and Medicines and Healthcare products Regulatory Agency (MHRA). For manufacturers, especially those operating internationally, meeting these standards can be complicated due to variations in GMP across regions.

A notable example of a manufacturer falling foul of an FDA inspection took place in India in 2023, which led to production being halted and resulted in shortages of the chemotherapy medications carboplatin and cisplatin. In some cases, the cost and difficulty of compliance may mean manufacturers voluntarily exit the market, further exacerbating supply scarcity.

Distribution and shipping delays

Even when production runs smoothly and quality control is met, transport and distribution inefficiencies can threaten the availability of clinical supplies. Geopolitical instability – from events such as the wars in Ukraine and the Middle East – has led to shipping lines being rerouted, resulting in delayed or cancelled deliveries. Additionally, customs complexities caused by Brexit have led to delays and bottlenecks at border checkpoints entering and exiting the UK.

Delays are especially hazardous for temperature-sensitive medications such as intravenous oncology treatments. For instance, a shortage of intravenous etoposide in between 2018 and 2020 was associated with an increase in hospitalisation and decrease in survival rates among patients with extensive-stage small-cell lung cancer.

Drugs such as these require cold-chain logistics networks to keep them at a certain temperature during transport and storage. Any break in the cold chain – whether due to inadequate packaging, power outages, poor monitoring or mislabelled packaging – can render the entire shipment unusable as the drugs become either ineffective or hazardous. The waste and spoilage caused by cold chain failure not only increases costs but also exacerbates existing shortages.

Further complicating matters is the widespread use of just-in-time (JIT) logistics. This lean model of operation is designed to reduce overheads, with little to no room for error. In terms of extra time or back-up stock, any delay in transport or production can lead to undersupply. This can then compromise the validity of a trial if patients are unable to adhere to dosing schedules.

Limited and low availability of medical products

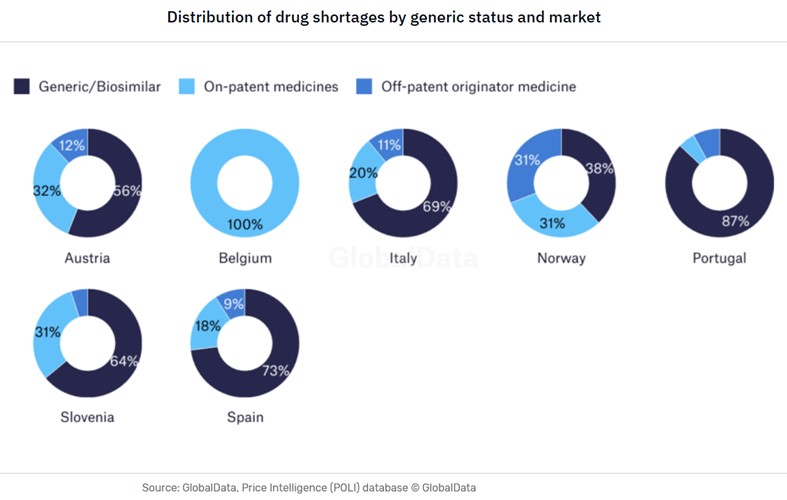

The types of drug shortages can vary from country to country – even in closely aligned markets such as within Europe, as demonstrated by the GlobalData analysis below regarding the shortages of generics in the domestic markets.

Another critical vulnerability lies at the very start of the clinical supply chain with the production of active pharmaceutical ingredients (APIs). According to GlobalData’s Strategic Intelligence Technology China Tech 2025, the US sources 80% of its API imports from China and India. These countries also produce the key starting materials (KSM) for between 90% and 95% of US generic sterile injectables (GSI), which include many oncology treatments.

The small number of source countries leaves clinical supplies considerably exposed to shifting national policies, import controls, diplomatic tensions, and geopolitical risk. This is exemplified by the sweeping US tariffs that went into effect on 1 August 2025, which put a 25% tariff on imports from India. While a US-China trade deal has yet to materialise.

Re-shoring manufacturing

In addition to the tariffs, the US is implementing other policies aimed at re-shoring pharmaceutical production and encouraging supplier diversification. The US BIOSECURE Act will make it mandatory for US pharmaceutical and biotech companies that receive federal funding to end relationships with five Chinese biotech manufacturers.

This proposed legislation puts significant financial and political pressure on pharma companies to switch to domestic manufacture of APIs and KSMs. Europe is following a similar trajectory with some key differences. Two initiatives in France and one in Austria are incentivising regional API production through government funding and support.

However, such a substantial supply chain adjustment takes time. Many manufacturers in the US, EU, and UK do not have the capacity or technology to immediately take over production from India and China. Factories need to be retrofitted to produce APIs in a GMP-compliant manner, and local workforces may need training.

In the interim, shortages are inevitable. Some pharma companies may choose to exit the market instead of taking on this additional cost burden of redesigning existing facilities, further contributing to the contraction of output.

Production capacity and strategic decisions

Even the facilities designed and equipped to produce KSMs and APIs can have limited production output. The physical constraints of smaller manufacturing facilities can restrict the ability to scale up quickly, and high production costs mean some larger manufacturers may choose not to.

“Sometimes, the smaller manufacturing facilities don’t have the capacity to actually do the runs fast enough,” says Khan. “And then some of the bigger organisations won’t do the small manufacturing runs because it’s not worth their while to make something that might produce 1,000 tablets.”

Manufacturers not only have to make strategic decisions about whether to do a production run in the first place, but also the drug class that should take priority based on projected margins and the effect on the company’s market position.

“Do you actually then utilise your manufacturing line for paracetamol, or do you utilise it for oncology medication? This is more of an ethical dilemma,” says Khan. “Your volume might be less, but the cost will be more,” she adds. “But you know you’ll get 100,000 tablets of paracetamol versus about 1,000 packs of an oncology drug.”

For niche or low-volume medications, there are often few incentives to continue production. The consequence is that it is ultimately patients that are left without treatments.

Inflation and cost pressures

Macroeconomic factors also play a role in drug shortages. Rising prices for raw materials, energy, labour, and compliance can restrict profit margins. In some countries, price caps and reimbursement costs can reduce profit margins even further, placing additional financial strain on manufacturers. When faced with thin margins, pharma companies might delay production, reduce batch quantities, or even cease manufacture entirely.

These cost pressures can lead to market consolidation, reducing an already small number of suppliers even further. Any merger itself can be costly as the acquiring company may have to reapply for licences previously held by the smaller company, resulting in products being taken off the market while the issue is resolved.

The importance of strategic partnerships in clinical logistics

With so few of the causes of drug scarcity within their control, clinical trial sponsors and CROs have little choice but to accept that the risks of medicine scarcity are ever-present. However, it is possible to take steps to mitigate the risks by partnering with specialists in clinical logistics that understand the nuances of pharma supply chains.

Navigating the patchwork of global regulations is a key challenge in logistics. Working with clinical logistics specialists can help reassure sponsors and CROs that all procurement activities will comply with legal and regulatory requirements and certifications regardless of regional and geographic variations.

Accurate labelling is vital for sponsors and CROs to identify the drugs that are investigational, placebo or comparators to ensure that patients in different control groups receive their designated medication. The use of correct labels to confirm product ingredients, dosage instructions, and explicitly state warnings is also essential for compliance with trial regulations.

In addition, labelling reduces the potential for delays that could lead to the discontinuation of a trial. Oximio covers all aspects of the procurement and supply chain process, ranging from inventory control and data integrity to administration tasks and labelling.

Reducing customs delays

By leveraging a network of customs or bonded warehouses – where goods are treated as being outside of the customs territory – trial sponsors that partner with Oximio can defer the payment of import taxes and fees. This approach enables sponsors to improve their cashflow and minimise burden of administration and paperwork.

To further safeguard consignments of clinical supplies against customs delays, Oximio offers full sets of documentation, including Contract of Affreightment (CoA), Certificate of Conformity (CoC), and Material Safety Data Sheet (MSDS) for each product.

Effective distribution and cold chain logistics

Logistics partners that understand how to integrate buffers of surplus stock and extra time in schedules can provide critical support against unforeseen events such as natural disasters and geopolitical conflicts that may lead to delays or abandoned cargo altogether. Oximio typically builds an extra third more time into logistics schedules to accommodate for potential.

“When determining manufacturing timetabling, if they say three months, we’ll say three to four months,” explains Khan.

Maintaining the safety and integrity of temperature-controlled drugs requires cold-chain storage, transport and packaging, as well as temperature performance monitoring. Cold-chain logistics helps prevent medicines from expiring, which reduces the risk of shortages and products going to waste.

Oximio can protect the safety of sample products by offering depots and warehouses. Other distribution and storage facilities available can support the four temperature requirements of ambient, refrigerated, freezer, and ultra-low freezer.

Efficient drug sourcing and procurement

A clinical trials logistics partner will often have specialist industry knowledge to overcome the challenge of limited supply by offering centralised and localised sourcing. Effective comparator sourcing involves selecting suitable suppliers based on cost, quality, reliability, geography, and regulatory requirements.

Oximio has extensive experience in handling vendor management by nurturing and maintaining positive relationships with suppliers to foster long-term collaborations. Alongside this, we also have a comparator sourcing team that scans the market for product availability with the aim of obtaining the best prices for clients within optimum lead times.

The causes of drug shortages – manufacturing issues, quality control issues, shipping delays, complicated regulations and re-shoring – are diverse, interconnected, and cannot be resolved overnight. However, through planning, diversifying sources and partnering with clinical trial logistics specialists can go a long way in ensuring a steady flow of medications for clinical trials.

Despite rising costs, Oximio’s teams of experienced negotiators regularly secure competitive pricing and favourable terms for a variety of products.

With more than two decades of experience in the clinical supply logistics, we can offer in-depth research, extensive networks, and expert sourcing capabilities. This all provides the capabilities to help our partners source high-value pharma supplies safely and consistently, successfully navigating multiple areas of potential disruption.

Cell and gene therapy: The vital role of logistics

By 2030, the cell and gene therapy market is projected to be worth £76.03bn, with a substantial compound annual growth rate of 44%. This major growth not only represents a market opportunity but also a logistical challenge unlike any other in healthcare. With investments in the billions of dollars, how will the industry overcome the bottlenecks associated with transportation and regulatory compliance that could potentially threaten this potential?

Cell and gene therapies (CGT) offer hope to patients living with life-threatening conditions where limited treatment options may be available – and logistics is one of the most important aspects.

Treatments have the potential to significantly improve the lives of patients with a diverse range of diseases and conditions, from cancers and blood disorders to neurodegenerative and autoimmune conditions.

Some clinical trials have found that cell and gene therapies can be administered as a first-line treatment, without requiring any follow-up – even curing conditions entirely in certain cases. This could transform the current drug pricing model, shifting from regular doses over time to a single treatment.

However, the success or failure of treatments can all rest on logistics. Furthermore, the highly sensitive nature of materials and personalisation of treatments can require bespoke logistics solutions.

The projected growth of the cell and gene therapy market

GlobalData estimates that the cell and gene therapy market will achieve global sales of $76.03bn by 2030, up from $5.88bn in 2023, with a compound annual growth rate (CAGR) of 44% over the seven years.

Oncology already dominates the space, which is expected to continue to 2030 and account for 51.6% of the global market, valued at $39.3bn. Metabolic disorders will comprise an estimated 10.6% of the market at $8.1bn by 2030, followed by haematological disorders worth $5.4bn at 7.1% of the global sales total.

Within oncology, most use cases are for blood cancer, but there are promising trials underway targeting solid tumours. Other potential treatments are in development for haematology, neurodegenerative diseases – such as Alzheimer’s, Parkinson’s, and multiple scoliosis – as well as the autoimmune space.

The majority of the T-cell immunotherapy (TCI) landscape comprises chimeric antigen receptor T-cell (CAR-T) immunotherapy products, accounting for 73% of all active TCIs, according to GlobalData. In addition, the TCI market is projected for significant growth, rising from $13m in 2017 to $30bn in 2030, says GlobalData.

Autologous therapies make up 76% of CGT treatments in development, compared with allogeneic cell therapies at 24% in oncology.

However, there has been an increase in the development of allogeneic therapies for areas such as blood cancers. As such products would effectively be off-the-shelf treatments, this could transform patient access to therapies and even bring down prices.

Cost barriers to cell and gene therapy treatments

A major barrier to patients for treatments is the high costs involved. In Europe, the cost of CAR-T cell treatment varies by country, with the average ranging from $55,000 to $450,000. Prices in the US typically start from $370,000, with $100,000 in Israel, and $55,000 in China.

For gene therapy in the US, there are eight FDA-approved oncologic treatments, with prices ranging from $65,000 to $475,000. However, costs can soar even higher. The world’s most expensive drug is a gene therapy treatment for metachromatic leukodystrophy (MLD). Lenmeldy, or Libmeldy in other markets, is a one-time treatment with a reported cost of $4.25m.

With treatment costs so high, even the smallest logistical failure could cost not just time and money – but also lives. In the future of healthcare, speed and precision are of the essence.

Transportation of cell and gene therapy products

Logistical complexities for these types of advanced treatments require personalised processing and close coordination between healthcare providers and logistics teams.

As cell and gene therapies contain living materials, the end-to-end supply chain contains far greater complexities than standard pharmaceuticals. Given the sensitivity of cell and gene therapy products, the capacity to offer a variety of storage and transportation options is imperative to meet specific requirements.

Precision is required at every stage, along with coordination and clarity between different stakeholders. Stringent compliance is also necessary given the time-critical and personalised treatments. The first step is selecting a donor for the starting material, which is from the patient in autologous therapies. Cell collection occurs from a procedure such as apheresis or a biopsy.

To maintain the integrity of cells through transit and storage, materials may be frozen through cryopreservation to avoid degradation. In addition, strict controls must be in place to prevent contamination. Such logistics requires specialists in cold chain logistics, which need to maintain a full chain of custody and ensure traceability.

When a starting material arrives at the modification site, bioservices teams will need to handle the thawing and initial processing. In addition, documentation of the material is required, along with clearly defined next steps for modification and expansion.

To optimise timeframes and resources, expert consultants may oversee processes and ensure compliance with regulatory and GMP requirements.

Once the modification process is complete, the enhanced therapy is sent to the clinical site where the patient will be treated. Given the small window for delivery, the process must be strictly controlled – with any last-mile logistics considerations in place.

Once the therapy arrives at the treatment site, final quality checks are undertaken before preparation and then administration to the patient.

Precision logistics in biopharma

With the condition of the product and timing crucial for successful treatment, the precision of logistics is critical. Any delays can cause treatments to fail. Time is of the essence, as the patient may not always be able to wait for treatments. Furthermore, if a shipment does not reach the patient in time, it may be necessary to start the cell extraction process all over again. This can extend treatment timelines, raise costs, and put the patient at risk of their condition worsening.

A further complexity is in the regulations. There are compliance considerations around the difference between autologous and allogenic therapies regarding approvals and regulatory requirements.

As the industry adapts, the existing regulatory framework may not align cohesively with innovative treatments. Consequently, it is essential to be certain of regulatory requirements – especially if operating across borders.

One option for autologous therapies to navigate regulatory paths is via a compassionate basis. Allogenic therapies require more stringent regulatory scrutiny due to their potential to be mass-produced and distributed across multiple patient populations. Nevertheless, both present logistical challenges when operating across different regulatory environments.

The technologies enhancing logistics for the future of cell and gene therapy

When every second counts, tracking and real-time monitoring are vital throughout logistics to determine exactly where a shipment is. Technologies such as Internet of Things sensors can monitor shipments with precision, sending alerts when there are any deviations in temperature.

The deployment of artificial intelligence (AI) and machine learning can optimise transformation routes and avoid any obstacles. In addition, AI can run multiple scenarios and predict possible outcomes to stay ahead of the curve with unforeseen events such as roadworks and poor weather conditions.

On top of this, the use of blockchain can provide a robust and reliable audit of each stage of logistics to provide transparency throughout the supply chain. In addition, blockchain can deliver greater efficiencies in ensuring regulatory compliance and reducing human error.

Specialist services in cell and gene logistics

Transporting cell and gene therapies requires specialists in logistics. Oximio is an experienced provider of cold chain logistics with state-of-the-art facilities at its warehouses, a courier fleet, and experts in regulations across all major market regions. The company also works globally with trusted partners to ensure shipments arrive on time and in the necessary conditions.

A cell and gene therapy sponsor approached the company with precise end-to-end logistics support requirements. The biological materials were highly sensitive and required two precise temperature ranges. The first required conditions of -70°C for biosamples such as whole blood and tissues. The second needed temperature of approximately -196°C for an investigational medical product.

Drawing on extensive experience, Oximio developed a bespoke logistics plan with robust quality controls in place. Close collaboration with teams on the ground and stakeholders was essential.

For materials requiring ultra-low temperature storage, the company developed insulated containers filled with dry ice, along with real-time temperature monitoring to deliver continuous cold chain integrity.

The result was that all materials arrived in the necessary conditions, with the temperature successfully maintained and validated throughout. Operating across borders, all regulatory and safety standards were met.

With cell and gene therapy projected for major growth in the future of healthcare, specialists in logistics are pivotal to realising the potential for patients.

Cell and Gene Therapy Logistics from Oximio

For further information on how we can support your cell and gene therapy logistic requirements, please contact us. We’d welcome the opportunity to discuss your needs.

Pharma Labeling Solutions for Clinical Trials in Africa

Pharma labeling is a critical component in the execution of global clinical trials. Its importance cannot be overstated, particularly when operating across the diverse and multilingual landscape of Africa. As a continent comprised of 54 countries, each with its own regulatory requirements and languages, delivering consistent, compliant, and clear pharmaceutical labeling presents both a challenge and an opportunity for excellence.

At Oximio, we specialise in pharma labeling services tailored to the unique needs of clinical trials conducted in Africa. Our regional expertise and practical experience ensure clinical trials comply with local regulatory standards whilst upholding the highest levels of global quality and accuracy.

What is Pharmaceutical Labeling and Why Does it Matter?

Pharmaceutical labeling refers to the process of affixing clear, accurate, and regulatory-compliant information on investigational medicinal products (IMPs). Labels typically include crucial details such as:

- Trial code and product name

- Dosage and route of administration

- Expiry date and/or retest date, batch number, and storage instructions

- Blinding/randomization codes

- Warnings and sponsor information

- Any instructions where necessary

Errors, or omissions, in clinical trial labeling can delay approvals, jeopardise the validity of a trial or even cause trial termination. All these unnecessary risks can be mitigated by working with an experienced labeling partner.

Clinical Trial Labeling

Pharmaceutical labeling requirements for clinical trials in Africa often require a blend of labeling approaches. These include:

Labeling for IMPs

Standardised information compliant with regional and international regulations. This is essential for conveying the precise details of products within a study.

Just-In-Time (JIT) Labeling

JiT labels are created and applied shortly before dispatch, allowing for dynamic changes based on local languages, patient requirements, and trial site logistics. This flexibility reduces waste and ensures country-specific compliance.

Relabelling and Export Preparation

For some clinical trials, materials may arrive “unlabelled” and require country-specific adaptations. Oximio manages this through precise relabelling, secondary packaging, and patient kit assembly, all whilst maintaining the integrity of the primary pack.

Overcoming Language Barriers with Expert Label Translation

Language diversity in Africa is vast. It requires careful attention to translation accuracy and cultural appropriateness. Our label translation services ensure that each label meets regulatory guidelines and is understandable to the end-user.

We integrate robust quality assurance procedures and local linguistic reviews, eliminating ambiguity and reducing regulatory risk.

Why Choose Oximio as your Pharma Labelling Partner?

At Oximio we recognise the crucial role of accurate pharma labelling in clinical trials. We’ve bolstered our capabilities to meet the individual and stringent demands of each clinical trial, ensuring compliance and traceability across diverse regions. Our services are labelled with precision and care. We offer:

- Multilingual Labeling & Translation

- Custom Label Design for Country-Specific Needs

- Relabelling & Repacking for Cross-Border Trials

- GMP-Compliant Secondary Packaging

- Just-in-Time Labeling & Patient Kit Assembly

- Regulatory Advisory for African Markets

Our experienced staff understand the intricacies of clinical trials across African regions including South Africa, Kenya, Namibia, Nigeria, Malawi, DRC to name but a few, from local language requirements to strict documentation and inventory control during distribution.

We believe that your clinical trial deserves a partner who understands the local nuances of the African market while adhering to global pharmaceutical standards. Oximio brings extensive industry knowledge, technical expertise and regulatory insight to every label we produce.

Let us help you navigate the complexity of running a clinical trial with confidence and complete peace of mind. Contact us today to discuss your labeling requirements for your next clinical trial in Africa.

Navigating new EU regulations in the clinical supply chain

Navigating new EU regulations in the clinical supply chain

Understanding the EU Clinical Trial Regulation (CTR) is crucial for clinical trial sponsors as it marks a significant shift in how trials are authorised and managed across Europe.

The CTR was introduced in the EU in January 2022 to improve efficiency in new trial regulatory processes. Sponsors can now apply for clinical trial authorisation in up to 30 European countries from a single application, eliminating the need for separate authorisations from national authorities and ethics committees.

Alongside the CTR, the EU has introduced a new unified portal for submitting and managing trial data, the Clinical Trials Information System (CTIS) regulatory platform.

The platform was launched to reduce the need for duplicate work and improve consistency in application assessments. All clinical trials in the EU from 30 January 2025 must now comply with CTR and be submitted through the CTIS. This includes CROs operating in the EU.

However, the introduction of the CTIS has not been without its challenges. Full implementation has been slow due to delays with adoption and hesitancy, technical limitations, manual data entry, and organisational restructuring for some sponsors.

In this latest insight, we explore how the EU’s new Clinical Trial Regulation (CTR) and the CTIS platform are reshaping clinical trial approvals and supply chain operations, offering streamlined processes and transparency, while introducing new challenges in logistics, compliance, and supply planning.

US WHO & USAID Policy Changes: Impact on Africa’s Healthcare

The US policy changes to withdraw from the World Health Organization and cut United States Agency for International Development (USAID) have had repercussions on clinical trials and humanitarian programmes across Africa. We explore the impact on clinical supply teams on the ground who are dealing with the consequences.

The clinical supply chain in Africa is striving to manage the impact of the US decision to withdraw from the World Health Organization (WHO) and significantly reduce USAID.

The US administration has indicated it will formally exit the WHO in January 2026. Given the annual US WHO contributions amounted to a reported $1bn in recent years, the nation’s withdrawal will put a sizeable dent in the organisation’s budget.

Further challenging news for the clinical supply chain came when the US administration announced plans to reduce USAID contracts. In March 2025, it was confirmed that 83% of USAID programmes would end. Some reports suggest that as much as $60bn in funding could be pulled globally as a result.

These decisions certainly create challenges in Africa. The region has the highest disease burden of any continent. Aid programmes provide a literal lifeline for countless people. Crucially, Africa has so much to offer in clinical trials, with a diverse and unsaturated patient pool that is largely untapped for the development of new drugs. There is much to offer for parties stepping in to fill some of the gaps.

How US cuts are predicted to drive an increase in infection rates

The US policy changes have raised concerns about increases in mortality rates. Experts have predicted that the changes could lead to new strains of tuberculous that lack treatments.

Even before the recent US announcements, Mycobacterium tuberculosis infections were forecast to rise in South Africa between 2024 and 2033, according to epidemiologists from GlobalData. In 2024, there were 370,000 diagnosed cases. By 2033, this is projected to rise to more than 430,000 diagnoses. These figures gave South Africa the highest number of M tuberculosis cases across the 16 major pharma markets in 2024, with more than 615 infections per 100,000 people.

In addition, there were warnings that the roll-back of US support could result in a spike in malaria cases across Africa as the number of vaccines available reduces.

There are also predictions that the US policy changes could lead to the deaths of 500,000 people from HIV/AIDS just in South Africa within the next decade.

“Look at South Africa as just one example. As of 2025, the estimated HIV prevalence rate in South Africa is approximately 12.7% of the population. This translates to around eight million people living with HIV,” explains Celeste de Vries, Regional Director of sub-Saharan Africa for Oximio.

Oximio is a specialist provider of clinical logistics solutions in several locations worldwide and works throughout sub-Saharan Africa. In South Africa, Oximio has a specialist facility that offers temperature control storage for medical supplies, with a customs-bonded warehouse in Kenya.

The impact of US policy changes on the clinical supply chain

Sources on the ground suggest that clinical trials in Africa are already being cancelled and companies are pulling products from storage facilities.

The US policy changes have also caused knock-on effects that must be assessed to fully understand the scale of the challenges now facing wider healthcare in Africa.

“The impact of medication and financial support for HIV alone is far-reaching,” adds de Vries on the situation.

It is not just patients who are affected, but also the increased burden on the medical care facilities and staff, the home support structures, as well as the possibility that the sick and vulnerable may lose their income or spend more money on accessing treatments.

Adapting to global instability in the clinical supply chain

The US policy changes are being felt throughout the supply chain, back to the manufacturers. “The impact is real and it’s not just on the patient,” says de Vries. “From a business point of view, the impact is immediate.”

The ability to adapt is vital for businesses working in the clinical supply chain. To help to mitigate these new challenges, partnerships are vital. Other countries, private sector initiatives, and local governments are stepping in to manage the consequences.

Oximio is also working closely with its clients and partners wherever possible to develop solutions. While there is a limit to how much help the company can provide, options are being explored.

“We’ve made a commitment to our clients to sit with them individually and hear all their concerns and address them one-by-one,” adds de Vries. “We can’t, from an ethical perspective, say we’re going to stop managing your trials, medication, or products. We can’t not charge any fees. But we can come up with solutions for each client.”

Africa has much to offer clinical trials. For a continent with so much untapped potential, those willing to provide support can still reap the many rewards in these challenging circumstances. Despite the downward health predictions, there remains resilience and a hint of optimism in the clinical supply chain.

And with challenges will come eventual solutions. “There is a spark of hope,” adds de Vries.

Tackling Obesity and Its Heavy Impact on Society and the Economy

The world is at a pivotal moment as it strives to tackle obesity, a growing health crisis that now threatens not just individuals but global economies. According to a recent report by Global Data, the obesity market is set to soar to a staggering $173.5 billion by 2031, driven by innovative medical breakthroughs such as GLP-1 receptor agonists. The report estimates that there are presently over 200 million people living with obesity in the 7 major markets: US, France, Germany, Spain, Italy, UK and Japan. As obesity rates climb, so too does the demand for more effective treatments, reflecting a rising awareness of the severe health risks and the growing commitment to reversing this trend.

Behind the staggering figures, the reasons for this intense focus on obesity are rooted in not only profound health but also economic impacts. Obesity is no longer seen as just an aesthetic issue – it’s a ticking time bomb for public health. It is a leading cause of Type 2 diabetes, a chronic disease that demands lifelong management and can result in devastating complications, including kidney disease, nerve damage, and even amputations. Beyond diabetes, excess weight is directly linked to heart disease, stroke, certain cancers, and sleep apnoea, all of which come with their own set of health challenges. The rise in obesity-related diseases is placing an enormous strain on healthcare systems globally, with treatment costs soaring as hospitals and clinics grapple with the demand for care.

Obesity’s Economic Impact

Obesity’s economic impact is substantial. Managing obesity-related conditions, such as diabetes and heart disease, has become a major economic burden on both public and private healthcare systems. Hospitals are seeing an increase in surgeries, emergency treatments, and long-term care for chronic illnesses. For individuals with obesity, it’s not just about addressing immediate health concerns, it requires ongoing medical treatment, prescriptions, and interventions throughout their lives. As obesity rates rise, the demand for more comprehensive and prolonged care also increases, driving costs to unsustainable levels.

Obesity and the Workplace

But the impacts of obesity are not confined to the healthcare sector. The workplace too is feeling the strain. Obesity-related health issues often lead to increased absenteeism, as workers require more time off for doctor’s appointments, treatments, or simply to recover from illness. This, in turn, reduces productivity, placing further economic pressure on businesses. For some, obesity can lead to early retirement or permanent disability, further inflating the cost to social welfare systems. But it doesn’t stop there. Many obese individuals face difficulty securing employment, battling both direct discrimination and the physical challenges that prevent them from fulfilling job requirements. This creates a vicious cycle of unemployment and reliance on government assistance, intensifying the economic challenges.

Mental Health Burden

Socially, the impacts of obesity extend beyond physical health. The mental health burden is considerable. People living with obesity often face depression, anxiety, and other psychological struggles that demand not just healthcare but support services, therapy, and medication. Additionally, the social stigma surrounding obesity can lead to feelings of isolation and diminished self-esteem, further exacerbating the emotional toll. As much as obesity impacts the body, it also leaves a deep psychological scar that can be just as hard to heal.

Tackling Obesity with Investment in Research

But there’s hope. While the economic and social costs of obesity are high, so too is the potential for change. Global Data’s report forecasts that the obesity market is set to grow at a compound annual growth rate (CAGR) of 32.3%, until 2031, across the seven major global markets. The report states that there are currently 141 products in clinical development for obesity. This rapid expansion reflects both the increasing recognition of obesity as a serious disease and the growing commitment to addressing its wide-ranging health impacts.

Investing in prevention, such as weight management programs, better access to fitness resources, and public health education, can help reduce the long-term financial burden of obesity-related diseases. Early interventions, including the use of treatments such as GLP-1 receptor agonists – medications that help control blood sugar, support weight loss, and provide cardiovascular benefits – can play a key role in reducing healthcare strain by preventing obesity from advancing to more severe conditions.

The global response to obesity has become a pressing priority, not just for individuals, but for the health of nations and economies. With obesity rates rising across the globe, governments and businesses alike are investing in a healthier future to ensure that healthcare systems remain sustainable. The stakes are high, but with a united approach to prevention and treatment, there is a real opportunity to reverse the course and reduce the impact of this growing epidemic.

The future of our healthcare systems, and the lives of millions, depends on how we choose to confront obesity today. The investment is not just in medical treatments, but in a healthier tomorrow.

Real-World Challenges in Conducting Obesity Trials

Conducting clinical trials to address obesity presents significant operational challenges that demand tailored solutions.

Obesity trials, especially those involving injectable treatments such as GLP-1 receptor agonists, require a highly specialised supply chain approach. These trials demand stringent cold chain storage at temperatures of 2-8 °C and timely distribution to ensure the integrity of sensitive biological products. Coordinating these supplies across multiple trial sites, often spread globally, adds a layer of complexity. The logistics involved in obesity trials are particularly challenging, as sponsors and Contract Research Organisations (CROs) must navigate the nuances of cold chain management, customs regulations, and global distribution networksAs the regulatory landscape surrounding obesity trials continues to evolve, sponsors and CROs must stay on top of shifting guidelines across different regions. Regulatory variation between countries can create obstacles when it comes to obtaining approval for products, importing/exporting materials, or meeting specific compliance standards. This is where Oximio’s regulatory expertise comes into play – helping our clients overcome customs challenges and navigate complex international regulations efficiently and effectively.

Patient-Centric Supply Models for Obesity Trials

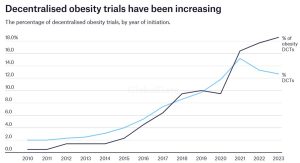

As obesity trials increasingly shift toward decentralised approaches, patient-centric supply models are becoming more prevalent.

Remote patient management, including direct-to-patient delivery and telemedicine monitoring, is rapidly gaining traction in clinical research. They allow for more flexibility in managing trials, especially in studies with long treatment durations. By adapting to the unique needs of patients, these models support faster, more efficient trials while also reducing patient drop-out rates. Oximio’s experience in managing these modern supply chain models ensures that patients receive their treatments on time and in the correct conditions, even in the most challenging logistics environments.

Risk Mitigation and Ensuring Trial Success

Obesity studies often span longer durations, which increases the likelihood of supply delays that can derail trial timelines. These delays can have significant consequences on the overall success of the trial and on the development of new treatments for obesity. However, by leveraging agile planning Oximio works to mitigate these risks proactively. Pro-active and agile planning can help to identify potential disruptions before they occur, allowing for swift action and minimising delays that could impact both study results and timelines.

Supporting Clinical Research with Agile Supply Chain Solutions

Oximio has been supporting clinical trials with flexible, tailored supply chain solutions for over 20 years. With a global footprint extending across Europe, North America, Africa, LATAM, MENA, and APAC, we are equipped to handle the complexities and operational challenges of clinical trials including those for GLP-1 treatments. From logistics management to regulatory compliance, we ensure that your trials run smoothly, even across borders and with the most demanding treatment protocols.

Why not contact us to find out how we can support your research? We’d be delighted to discuss your requirements.

Four Key trends in the Clinical Trial Supply Chain

Clinical trial supply chains have experienced significant changes in recent years. In the aftermath of the global pandemic, we identify the four key trends in the clinical supply chain and new locations sought globally.

The Covid-19 pandemic did much to expose the inefficiencies in clinical supply chains, revealing inconsistencies in inventory management practices and long-established procurement processes. The resulting consensus among the industry was that changes were required.

Four years on, steps have been taken to strengthen the supply chain and ensure that the pharmaceutical industry has the necessary resources despite challenging circumstances. However, multiple factors must continue to be reviewed for the sector to remain as resilient as possible in future.

New technology, sustainability concerns, geographic inequality, and the question of diversity are all starting to change how the clinical supply chain functions. We take a look at four key industry trends and examine how they will help drive the development of the clinical supply chain going forward.

Embracing new technology in Clinical Trials

The use of new technology has the potential to help bypass logistical challenges that negatively impacted clinical supply chains during the pandemic, and more recently during the Ukraine-Russia war.

Artificial intelligence (AI) is increasingly being deployed to optimise various processes. One of these uses is to improve the performance of the manufacturing line through robotics. When enhanced with 5G, AI, and connected to the Internet of Things (IoT), manufacturing robots can be programmed to adjust their performance to achieve optimal productivity and efficiency.

Alongside this, IoT technology is set to fill other important gaps in the clinical supply chain moving forward. GlobalData analysis predicts that the total healthcare IoT market will be worth $60.6bn in 2027, doubling in size from $30.3bn in 2022 at a compound annual growth rate of (CAGR) of 14.8% over the five-year-period.

Tech can be leveraged to create a ‘digital twin’ of any supply chain, which can then be examined to identify inventory issues, manufacturing bottlenecks, and other areas for optimisation. In addition, AI is being used to determine the most efficient logistics routes according to the unique requirements of a shipment and can adapt in real-time amid changing circumstances.

Improving sustainability across the supply chain

The growing importance of sustainable practices is also central to the clinical supply chain’s evolution. Awareness of environmental, social, and governance (ESG) issues is increasing, as illustrated by GlobalData’s Q4 2023 ESG Sentiment Polls. This survey found that 35% of respondents cited pressure from consumers, and 30% pressure from investors, as the primary reason for establishing an ESG strategy.

According to GlobalData, 90% of a pharmaceutical company’s emissions are Scope 3 emissions, meaning those generated by their supply chains as opposed to the company itself (Scope 1) or purchased energy (Scope 2).

As governmental bodies across the globe, from the EU to the US, seek to enshrine sustainable business practice into law, ensuring a low-waste, low-emissions supply chain is becoming more important than ever for pharma companies wishing to retain investment and market access.

Introducing recyclable packaging, eliminating single-use plastic, and investing in carbon-neutral transport are all trends increasingly being adopted across the supply chain to reduce environmental impact.

Decentralised manufacturing in pharma

After the Covid-19 pandemic exposed flaws in the traditional clinical supply chain model, decentralised manufacturing is increasingly viewed as a means to boost security and ensure certainty of supplies.

According to a report by the European Medicines Agency, decentralised manufacturing has the potential to enable patients to have easier and faster access to novel therapies due to the production facilities being nearer.

For many in the pharma industry, decentralised manufacturing offers greater flexibility with clinical supplies, reducing the reliance on a single facility by spreading operations out across more locations. Furthermore, using facilities across different regions enables suppliers to focus on specific items or raw materials. For example, if there is a particular demand for a material or product in one region, it can be served more effectively from a manufacturing facility closer to where it is needed.

Another advantage of decentralised manufacturing within a region is that it provides faster access to supplies.

If a shipment is being transported to the other side of the world, it must undergo a series of necessary regulatory checks to enter a particular territory.

However, if a facility within a region is already manufacturing the required items, there will be far fewer regulatory restrictions and potential delays at borders. Another important factor here is that the personnel working within these regional facilities will not only be well-versed with the regulations but also with how they are interpreted by authorities on the ground.

In addition, decentralised manufacturing supports greater collaborations between suppliers and manufacturers around the world, helping expand service offerings and capabilities.

Furthermore, decentralised manufacturing offers a significant advantage in areas such as biologics that may be particularly sensitive to environmental changes or unsuited to travelling long distances. Being able to transport sensitive clinical materials shorter distances more quickly is a substantial benefit for the clinical supply chain.

The need for diversity in clinical trials and the rise of Africa

Another factor set to influence the clinical supply chain is the increased diversity required for patient pools in trials to develop new treatments. Africa is one destination attracting particular interest for this purpose and holds immense potential.

Despite more than 18% of the global population living in Africa, GlobalData analysis reveals that there are currently only approximately 6,000 trials taking place there, which is less than 9% of the global total.

This discrepancy is especially pressing given that Africa has the highest disease burden of all the continents, including serious conditions such as HIV/AIDS, malaria, and tuberculosis – which all have high mortality rates. Populations across the continent that could benefit hugely from clinical research have typically been disproportionately underrepresented in the processes that produce life-saving medicines and vaccines.

Given that many diseases investigated by clinical trials most seriously impact countries in Africa, bringing the studies closer to patients will improve assessment outcomes and ultimately the quality of pharma products reaching the market. This also ties in with the trend of decentralised manufacturing.

The Oximio Group are global experts in the clinical supply chain industry and have rapidly improved their logistics capabilities across Africa by creating strong supply chains and risk management strategies. With continued development, the continent’s diverse population and increasing resources will provide all that is required to become a major player in the clinical supply chain in the years ahead.

Further Interest

eBook: Reshaping the Clinical Supply Chain in sub-Saharan Africa

The Clinical Landscape in 2025

As we enter 2025, the global clinical landscape is continually evolving, driven by a range of factors, including emerging therapies, technological advances, and logistical challenges. The industry is characterised by both opportunities for innovation and challenges that require strategic solutions to deliver clinical success.

Use of technology continues to gain momentum, enhancing patient engagement and streamlining data collection in decentralised and hybrid trials. Integration of advanced technologies such as AI and machine learning (ML) also gathers pace, reshaping clinical trials by reducing trial timelines and improving efficiency.

Yet the proportion of terminated trials has increased, reflecting financial pressures and geopolitical factors. In 2025, the focus will likely remain on enhancing efficiency, ensuring patient engagement, and navigating the complexities of a globalised clinical research environment.

In this report we provide an overview of key trends shaping clinical trials in 2025 using data and analysis from GlobalData’s Intelligence Center. We will also discuss emerging markets, new tech, the burgeoning field of medicinal cannabis, and underline the importance of logistics.

Download: Clinical Trial Landscape 2025

For further information on our services, please contact us.

Oximio Ukraine: Leading the Way in Clinical Trial Supply Chain Solutions During the War

Despite the ongoing war in Ukraine, the need for clinical trials remains critical. In 2024 alone, from January to October, 46 new studies received approval, with 40 of them being multinational collaborations and six local initiatives. This resilience highlights the essential role of clinical research in advancing healthcare.

Established in 2004, Oximio, Ukraine has a profound understanding of patient care and the complexities of the clinical trial landscape. We are proud to have positioned ourselves as a leader in the industry, currently supporting over 62% of the new studies approved this year. Our success is rooted in our commitment to continuity and adaptability, especially in these challenging times.

Navigating Challenges with Robust Planning

Thanks to comprehensive business continuity plans that ensure uninterrupted operations and the safety of our personnel we have continued to provide agile logistics solutions for sponsors and CROs within the country. Key strategies include:

Availability and Security of Warehouse Staff

The safety and availability of our warehouse personnel are paramount. We have constructed an anti-attack shelter adjacent to our warehouse to protect our team and ensure they can carry out their daily tasks without disruption.

Reliable Power Supplies

Our facilities are equipped with two high-power diesel generators that maintain electricity in all temperature-controlled areas, including refrigerators and freezers. Regular maintenance and testing have ensured these systems function without issues, and we maintain an adequate fuel supply for uninterrupted operations.

Backup Heating Solutions

To safeguard the integrity of our temperature-sensitive materials, our depots are fitted with alternative heating solutions that operate independently of gas supplies. The ventilation system at our Krushynka depot has been modernized, and we have implemented an additional independent electric heating system connected to our generators. Meanwhile, our Brody depot features a solid fuel heating system, ensuring we can maintain optimal conditions year-round.

Distribution Availability

We have secured ongoing fuel supplies through contracts with leading gas stations and have established a three-week fuel storage supporting the uninterupted completion of all deliveries.

Robust Communication Systems

To ensure seamless communication and coordination, our action plan includes provisions for internet connectivity disruptions. We have established connections with two internet providers, alongside backup satellite and fiber optic systems, ensuring we stay connected with our clients and partners globally.

A Commitment to Patient Care

At Oximio, our core values revolve around the safety of our staff and the delivery of patient care. We understand that the stakes are high in clinical trials, and our commitment to excellence drives us to adapt and innovate continuously. The ongoing conflict in Ukraine has posed many challenges, but it has also reinforced our resolve to support vital clinical research initiatives.

As we look to the future, we remain dedicated to providing unparalleled supply chain solutions for clinical trials, ensuring that the essential work of advancing healthcare continues, even in the face of adversity. Our international team, combined with our robust operational strategies, position us as a trusted partner in the global clinical research community.

Together, we are navigating these challenging times with resilience and purpose, ensuring that patient care remains at the heart of everything we do.

Clinical Trial Supply Chain Solutions Ukraine

If you are seeking support for your clinical trial within Ukraine, view our comprehensive supply chain solutions or contact us. Offering agile and tailor-made solutions, we would welcome the opportunity to discuss your unique requirements.

Hungary – A Strategic Location for Clinical Trials in Europe

In the search for efficient, cost-effective and high-quality sites for clinical trials, the pharmaceutical and biotech industries are turning to Hungary as a popular destination for their research. The country provides multiple advantages that make it a prime location for clinical research.

In this article, we explore why Hungary is emerging as a strong choice for clinical trial sponsors and contract research organisations (CROs).

Strategic Central European Location

Hungary’s geographical location in Central Europe places it at the heart of both the European Union and Eastern Europe. This central positioning allows for easier access to a broad patient base across the EU, as well as Eastern Europe, making it ideal for multi-country clinical trials. Proximity to other European nations reduces logistical costs and travel time, enhancing the efficiency of clinical trial operations. As such, Hungary serves as a gateway for studies targeting both Western and Eastern European markets, making it a natural choice for global clinical research teams.

Diverse Demographics and Patient Pool

Hungary’s population of approximately 9.6 million people, according to the World Bank (2023), provides a robust and diverse patient pool for clinical trials. The country is home to several ethnic groups, with the majority being Magyars, who have rich historical roots that span multiple cultures, including Sumerian and Slavic origins. This ethnic diversity can be particularly beneficial for clinical trials that require varied patient populations, offering opportunities to investigate how treatments perform across different genetic backgrounds.

Additionally, with a median age of 43 and a life expectancy of 76, Hungary’s population is predominantly middle-aged and older, which is often the focus of clinical research in therapeutic areas such as oncology, cardiology, and neurology. These demographics create an ideal setting for conducting trials involving chronic diseases and aging populations.

A Strong Healthcare System

As a member of the European Union, Hungary benefits from the high standards of healthcare regulation and oversight required for clinical research. The country operates a tax-funded, universal healthcare system that is managed by the state-owned National Health Insurance Fund. This centralised structure helps to streamline patient recruitment for clinical trials, providing researchers with a reliable and well-organised healthcare framework for trial participation.

Moreover, Hungary’s healthcare system prioritises patient access, ensuring that clinical trial participants receive high-quality care. This contributes to a positive experience for trial patients and helps build trust in the research process.

World-Class Medical Facilities and Expertise

Hungary boasts a well-developed medical infrastructure, which includes some of Europe’s most respected medical schools and research institutions. The country is known for its high standards of medical education, with universities like Semmelweis University and the University of Debrecen producing highly skilled medical professionals. Hungary’s hospitals and research centres adhere to the International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use (ICH) Good Clinical Practice (GCP) standards, ensuring that clinical trials are conducted with the highest levels of quality and ethical standards.

The country’s research centres are equipped with cutting-edge technologies, and its medical professionals are known for their expertise and motivation. This combination of skilled investigators and modern infrastructure makes Hungary an ideal location for clinical trials that require precise, high-quality research.

Clear and Efficient Regulatory Environment

Hungary benefits from a transparent and well-defined regulatory framework that supports clinical trials. The approval process for clinical trials in Hungary is notably efficient, with the average time from submission to approval typically taking around 10 weeks. This relatively short timeline accelerates the study start-up process, allowing clinical trial sponsors to initiate their studies without lengthy delays.

Hungary’s regulatory authorities, which includes the recent merger in August 2023 of the National Institute of Pharmacy and Nutrition (OGYÉI) into the National Public Health Centre, maintain a strong focus on safety, quality, and compliance. This provides confidence among sponsors and helps ensure that clinical trials are conducted smoothly and effectively.

Why Choose Hungary for Your Clinical Trial?

With its central European location, diverse patient demographic, high-quality healthcare system, exceptional medical facilities, and efficient regulatory environment, Hungary offers a compelling package for clinical trial sponsors. Whether sponsors are conducting a multi-country trial or looking for a reliable and cost-effective location for a regional study, Hungary provides the infrastructure and expertise to meet the most demanding needs.

Oximio’s Clinical Trial Supply Chain Solutions in Hungary

Established in 2020, Oximio Hungary, acts as a central European hub for Oximio’s operations within the region providing a strategic link across the EU and Eastern Europe with direct-to-patient access. Our Hungarian depot, with accredited GMP and MIA certification, provides essential temperature controlled storage for biological and pharmaceutical products.

If you are considering a clinical trial within the country, take a moment to explore our full range of supply chain services within the country. Or contact us. We’d be delighted to discuss your requirements.