WHITE PAPER • NOV 2025

Clinical Trials in Canada – How the Country Stands to Benefit in a Changing World

The global clinical trial landscape is undergoing rapid transformation, shaped by regulatory pressures, rising costs, geopolitical uncertainty, and growing demand for diverse patient populations. In this shifting environment, Canada is emerging as a strategically positioned hub for clinical research.

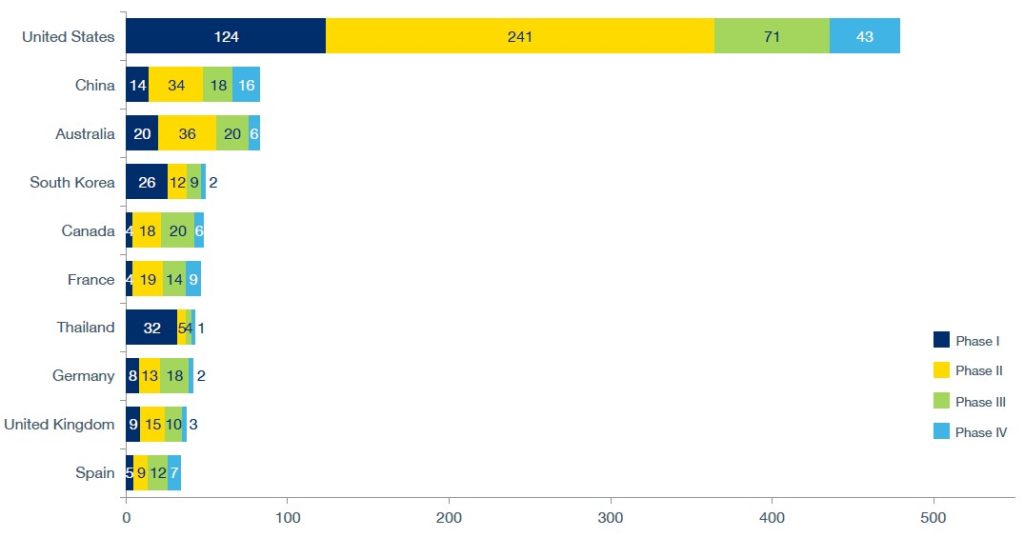

Already ranked among the top ten countries for clinical trials, Canada has the fifth highest number of planned clinical trials globally as of December 2024.

Canada has the opportunity to strengthen its global standing, with a Mutual Recognition Agreement signed with the European Union in 2021, and proximity to the US, the country with the most clinical trials in the world.

While US tariffs on drug imports pose risks to life sciences investors and sponsors, they also highlight Canada’s appeal as a stable, cost-effective, and reliable destination for sponsors and investors.

Global shifts in clinical trials

The global clinical development services market, which encompasses clinical trials, was forecast to be worth $61.7bn in 2024 and is expected to grow to $101.5bn by 2030, according to GlobalData, representing an 8.6% compound annual growth rate.

This growth comes with mounting complexity. Vast amounts of trial data now require intensive analysis, while patient recruitment and retention remain persistent challenges. Trials increasingly target narrower patient populations, raising costs and demanding more sophisticated designs.

The adoption of adaptive trials during the COVID-19 pandemic demonstrated flexibility but also introduced new complexities that drive up research and development expenses. On top of these scientific hurdles, regulatory and policy changes add uncertainty. For example, the US Inflation Reduction Act, which permits direct government negotiations on drug pricing, has raised concerns about reduced pharmaceutical revenues and diminished research and development (R&D) investment.

Geopolitical tensions further complicate trial planning. Supply chain instability has disrupted access to investigational medicinal products and comparator drugs, while potential retaliation from China against the US BIOSECURE Act could sharply increase the cost of running single country trials. Collectively, these pressures are encouraging sponsors to explore more stable markets, creating opportunities for Canada.

Planned clinical trials, country, by phase

Number of planned trials by country and phase.

Source: GlobalData Pharma Intelligence Center, as of December 2024.

Against this backdrop, Canada offers both stability and predictability. The country’s GDP growth is forecast at 1.4% in 2025, and it boasts a higher working-age employment rate of 74.7% than the US at 71.9%. Within the Americas, Canada is ranked lowest for legal risk and second lowest for political risk. Such a combination of economic resilience, political security, and reliable institutions makes Canada an increasingly attractive option for investors seeking long-term returns on clinical trial activity.

Canada’s Competitive Advantage

Canada’s appeal extends beyond stability. The country’s universal healthcare system provides free, high-qualitycare accessible across all 13 provinces and territories. This model not only facilitates broader patient participation in trials but also removes financial barriers that often skew representation in countries with private healthcare models.

Furthermore, by fostering collaboration among physicians and therapy area specialists rather than competition for patients, Canada creates an environment of trust that supports both patient care and the integrity of research.

Diversity is another major advantage. With a population of 36.99 million in 2021, Canada recorded over 450 ethnic and cultural origins in its census, with racialised groups, including Asian, Chinese, and Black communities, comprising 16.1% of the population. A highly educated workforce adds to this strength. Such diversity ensures that clinical trials capture data from a wide range of patient backgrounds, improving the ability to generalise trial findings.

Another important factor the receptiveness of the population to therapy treatments in general.

If vaccine hesitancy were to be used as a proxy for willingness to participate in clinical trials, the Canadian population is more receptive than that of the US. Specifically, for COVID-19 vaccine acceptance and hesitancy in June 2022, 87% of the Canadian population was receptive and 13% was hesitant. In the US, 80.2% was receptive while 19.8% was hesitant. Research has found that an increase in the number of ‘vaccine deniers’ or ‘anti-vaxxers’ can restrict the pool of trial participants.

Canada’s academic and research infrastructure further enhances its appeal. The country is home to 17 medical schools, 40 groupings of academic healthcare organisations, and more than 15,000 researchers. The Canadian Institutes of Health Research allocates more than $1bn annually to health research, while the federal and provincial governments collectively invest up to $3.2bn in life sciences R&D. Major pharmaceutical investments from Sanofi ($2bn) and AstraZeneca ($570m) further underscore confidence in the Canadian life sciences sector.

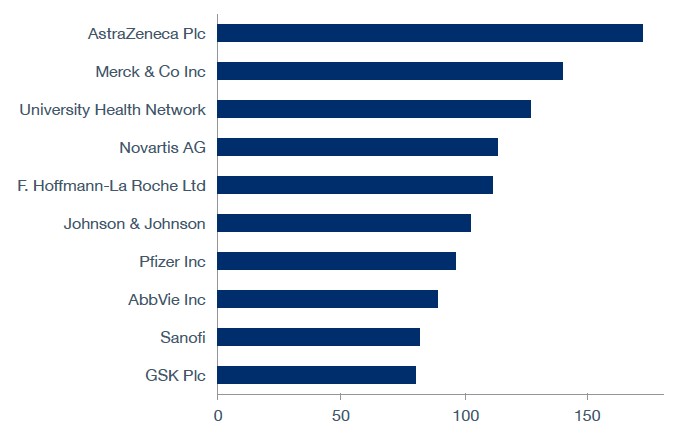

Top Sponsors

Top ten sponsors of completed and ongoing clinical trials in Canada since October 2020.

Note: The trials data relates to the company role as a sponsor and trials tagged to the parent company.

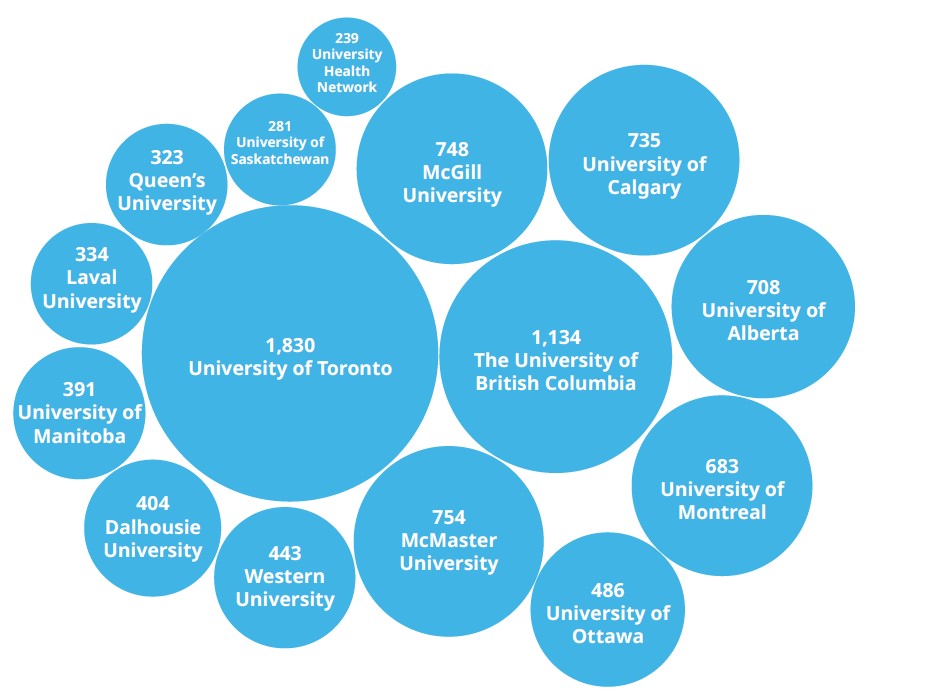

Institutions such as the University of Toronto (ranked 21st globally), the University of British Columbia (41st), and McGill University (45th) provide world-class research and talent pipelines. In addition, universities are the top three associated organisations for investigators of clinical trials.

Investigators by Top 15 Associated Organizations

Top 15 Associated institutions of clinical trials in Phase I-IV, Canada.

Source: GlobalData Pharma Intelligence Center

This academic strength, coupled with institutions such as the Canadian Clinical Trials

Coordinating Centre, provides robust infrastructure for conducting and coordinating studies.

The number of clinical trials in Canada ramped up significantly in 2001 when Health Canada became the regulatory authority responsible for clinical trial approvals oversight and inspections, in accordance with Canada Food and Drug Regulations. The new regulatory framework was instigated with two main objectives: to strengthen the protections for patients, and increase research and development investment in clinical trials in Canada.

The framework also includes fundamental elements of Good Clinical Practices such as ensuring sound clinical research and maintaining accurate records. A major change that this brought about was the shortening of standard review for Phase I trials in healthy volunteers to 60 days to seven days. This more favourable regulatory environment saw life sciences investors move into the Canadian market.

Economically, Canada’s pharmaceutical industry was valued at $25.55bn in 2020 and is projected to grow to $27.08bn by 2026, according to GlobalData. Regulatory changes in 2001 also streamlined processes, reducing Phase I clinical trial review times from 60 days to just seven days, while incorporating fundamental elements of Good Clinical Practice. Combined with R&D tax incentives such as the Scientific Research and Experimental Development program, Canada has built a pro-innovation environment that supports trial sponsors from start to finish.

Canada also benefits from its geographic position and advanced logistics infrastructure. With major trial hubs centres around Toronto, Montreal and Vancouver, sponsors have access to world-class airports, seaports and road networks with further investment for continuous improvement. The government has the Transportation 2030 strategic plan in place for a national transportation system that supports economic growth.

One of the themes of this federal plan is Trade Corridors to Global Markets, to optimise the flow of goods. There is also the National Trade Corridors Fund which will be funding projects until 2028 to improve the fluidity of Canada’s supply chains. As supply chains face increasing strain from geopolitical disruption, Canada’s reputation for regulatory compliance and logistical reliability positions the country as a standout choice.

Clinical Trials in Canada – The Numbers

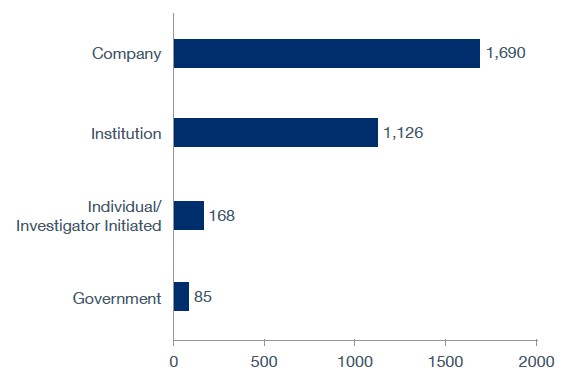

As of late-2024, the majority of clinical trials (1,690) were sponsored by companies, according to GlobalData. This is followed by 1,126 by institutions, 168 by individuals or investigators, and 85 by government bodies.

Sponsor Type

Top sponsor types of clinical trials in Canada as of late 2024.

Source: GlobalData Pharma Intelligence Center

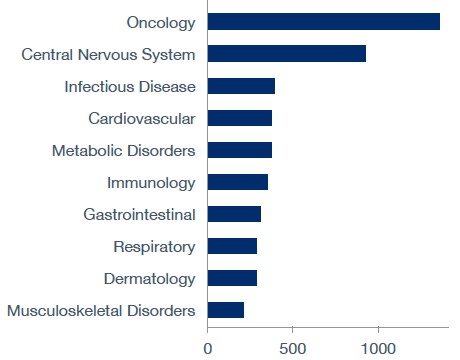

Top Therapy Areas

Top ten therapy areas of ongoing and completed trials in Canada since October 2020.

Source: GlobalData Pharma Intelligence Center

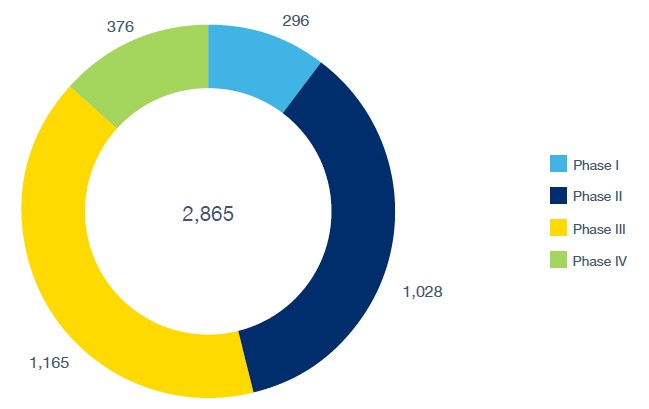

As of September 2025, GlobalData recorded Canada as having 2,865 active or ongoing trials in Phases I-IV. By phase, 296 trials were in Phase I, 1,028 in Phase II, 1,165 in Phase III, and 376 in Phase IV. These figures underscore both the scale and breadth of Canada’s role in global clinical research.

Trial Phase

Ongoing clinical trials in Canada by phase.

Source: GlobalData Pharma Intelligence Center

Supply chain challenges in clinical trials

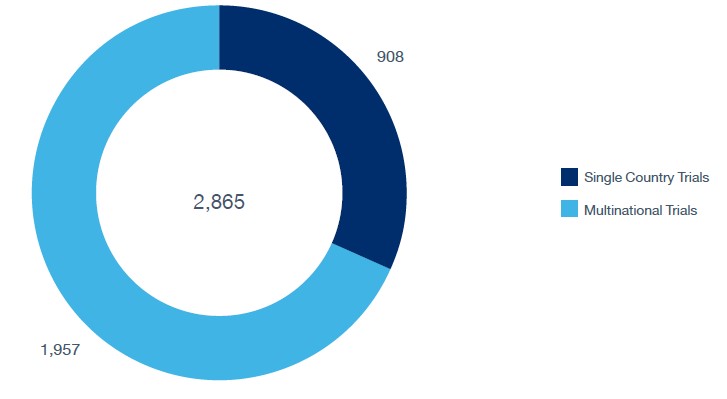

Despite these advantages, logistics remains a critical challenge. Clinical trial materials, including drugs, medical devices, and biological samples, must be transported under strict conditions, on time, and in compliance with regulations. Of the 235 planned clinical trials in Canada as of September 2024, GlobalData recorded 175 single-country studies, while 60 (25.5%) were multicountry, highlighting the increasing complexity of international operations.

Location Type

Ongoing clinical trials in Canada by phase.

Source: GlobalData Pharma Intelligence Center

Multi-country trials pose greater challenges due to varying time zones, customs regulations, and storage requirements. Effective logistics demand strict temperature control, sourcing and distribution networks, and precise storage capabilities. Delays or disruptions can directly affect patient safety and compromise trial outcomes. For this reason, sponsors increasingly depend on global logistics providers with experience in over 50 countries and the flexibility to navigate diverse infrastructures.

How 3PL can enable trial success in Canada

Third-party logistics (3PL) providers are critical enablers of trial success. Companies such as Oximio can offer these essential services. With more than 20 years of experience and operations across 50 countries, Oximio provides critical support to both large pharmaceutical firms and smaller biotech players.

Located in Hamilton, Ontario, Oximio BARL Canada offers a full suite of capabilities. The depot is located within the Greater Toronto and Hamilton Area, home to 7.2 million people. Capabilities offered include handling antibiotics, cytotoxins, dangerous goods, and ancillary supplies, as well as supporting temperature ranges from ambient (15°C to 25°C) to deep frozen (-60°C to -80°C).

Services include labelling (just-in-time), comparator sourcing, importer-of-record services, and both direct-to-patient (DTP) and direct-to-site (DTS) delivery. The depot is also certified with GDP and GMP licences. Such infrastructure ensures Canada can support the operational needs of modern trials while maintaining compliance and efficiency.

The global clinical trials industry is facing mounting pressures, from rising costs and regulatory uncertainty to supply chain challenges and geopolitical disruptions. Within this landscape, Canada is carving out a strong position. Its stable political and economic environment, universal healthcare system, diverse population, world-class academic and research networks, and pro-innovation regulatory framework make it an attractive alternative to less predictable markets.

With more than 2,800 active trials, growing pharmaceutical investment, and reliable logistics infrastructure, Canada stands to consolidate its role as a leading hub for clinical research. For sponsors, investors, and patients alike, the country represents not only a safe haven but also a strategic opportunity in a rapidly changing world.

Companies such as Oximio BARL Canada stand ready to offer the key logistics services required in clinical research.

Oximio BARL Canada

In October 2025, Oximio welcomed Bay Area Research Logistics (BARL), Canada to the Oximio family. This strategic move combines Oximio’s extensive global supply chain expertise with BARL’s considerable experience in North American and global markets and further strengthens, Oximio’s global footprint whilst enhancing its capabilities across the globe.

Find out how our tailor-made supply chain solutions can support your clinical trial in Canada and North America: https://oximio.com/network/canada/