Clinical Trials in Canada – How the Country Stands to Benefit in a Changing World

The global clinical trial landscape is undergoing rapid transformation, shaped by regulatory pressures, rising costs, geopolitical uncertainty, and growing demand for diverse patient populations. In this shifting environment, Canada is emerging as a strategically positioned hub for clinical research.

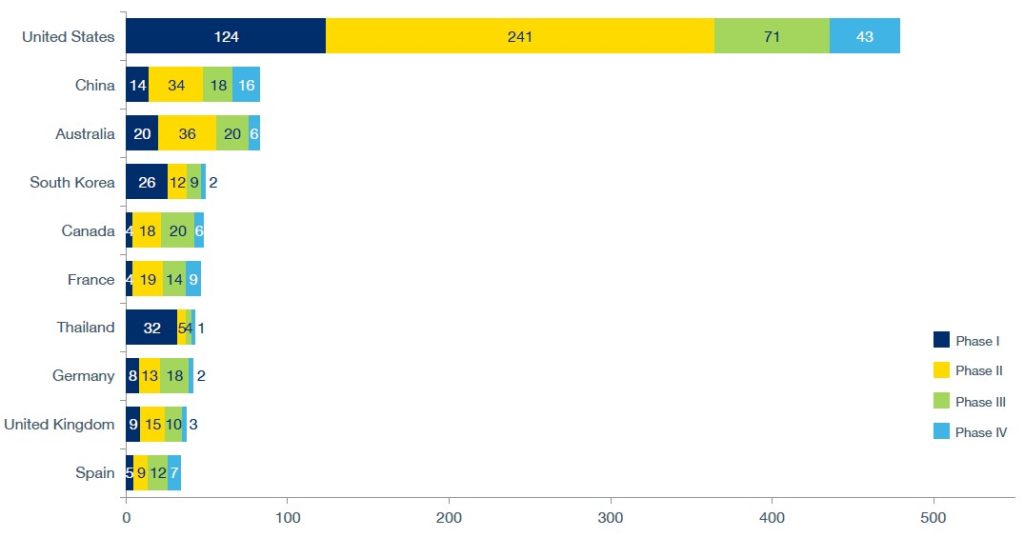

Already ranked among the top ten countries for clinical trials, Canada has the fifth highest number of planned clinical trials globally as of December 2024.

Canada has the opportunity to strengthen its global standing, with a Mutual Recognition Agreement signed with the European Union in 2021, and proximity to the US, the country with the most clinical trials in the world.

While US tariffs on drug imports pose risks to life sciences investors and sponsors, they also highlight Canada’s appeal as a stable, cost-effective, and reliable destination for sponsors and investors.

Global shifts in clinical trials

The global clinical development services market, which encompasses clinical trials, was forecast to be worth $61.7bn in 2024 and is expected to grow to $101.5bn by 2030, according to GlobalData, representing an 8.6% compound annual growth rate.

This growth comes with mounting complexity. Vast amounts of trial data now require intensive analysis, while patient recruitment and retention remain persistent challenges. Trials increasingly target narrower patient populations, raising costs and demanding more sophisticated designs.

The adoption of adaptive trials during the COVID-19 pandemic demonstrated flexibility but also introduced new complexities that drive up research and development expenses. On top of these scientific hurdles, regulatory and policy changes add uncertainty. For example, the US Inflation Reduction Act, which permits direct government negotiations on drug pricing, has raised concerns about reduced pharmaceutical revenues and diminished research and development (R&D) investment.

Geopolitical tensions further complicate trial planning. Supply chain instability has disrupted access to investigational medicinal products and comparator drugs, while potential retaliation from China against the US BIOSECURE Act could sharply increase the cost of running single country trials. Collectively, these pressures are encouraging sponsors to explore more stable markets, creating opportunities for Canada.

Planned clinical trials, country, by phase

Number of planned trials by country and phase.

Source: GlobalData Pharma Intelligence Center, as of December 2024.

Against this backdrop, Canada offers both stability and predictability. The country’s GDP growth is forecast at 1.4% in 2025, and it boasts a higher working-age employment rate of 74.7% than the US at 71.9%. Within the Americas, Canada is ranked lowest for legal risk and second lowest for political risk. Such a combination of economic resilience, political security, and reliable institutions makes Canada an increasingly attractive option for investors seeking long-term returns on clinical trial activity.

Canada’s Competitive Advantage

Canada’s appeal extends beyond stability. The country’s universal healthcare system provides free, high-qualitycare accessible across all 13 provinces and territories. This model not only facilitates broader patient participation in trials but also removes financial barriers that often skew representation in countries with private healthcare models.

Furthermore, by fostering collaboration among physicians and therapy area specialists rather than competition for patients, Canada creates an environment of trust that supports both patient care and the integrity of research.

Diversity is another major advantage. With a population of 36.99 million in 2021, Canada recorded over 450 ethnic and cultural origins in its census, with racialised groups, including Asian, Chinese, and Black communities, comprising 16.1% of the population. A highly educated workforce adds to this strength. Such diversity ensures that clinical trials capture data from a wide range of patient backgrounds, improving the ability to generalise trial findings.

Another important factor the receptiveness of the population to therapy treatments in general.

If vaccine hesitancy were to be used as a proxy for willingness to participate in clinical trials, the Canadian population is more receptive than that of the US. Specifically, for COVID-19 vaccine acceptance and hesitancy in June 2022, 87% of the Canadian population was receptive and 13% was hesitant. In the US, 80.2% was receptive while 19.8% was hesitant. Research has found that an increase in the number of ‘vaccine deniers’ or ‘anti-vaxxers’ can restrict the pool of trial participants.

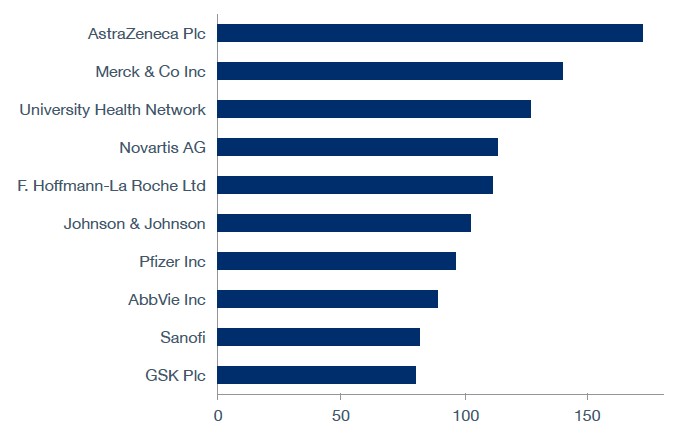

Canada’s academic and research infrastructure further enhances its appeal. The country is home to 17 medical schools, 40 groupings of academic healthcare organisations, and more than 15,000 researchers. The Canadian Institutes of Health Research allocates more than $1bn annually to health research, while the federal and provincial governments collectively invest up to $3.2bn in life sciences R&D. Major pharmaceutical investments from Sanofi ($2bn) and AstraZeneca ($570m) further underscore confidence in the Canadian life sciences sector.

Top Sponsors

Top ten sponsors of completed and ongoing clinical trials in Canada since October 2020.

Note: The trials data relates to the company role as a sponsor and trials tagged to the parent company.

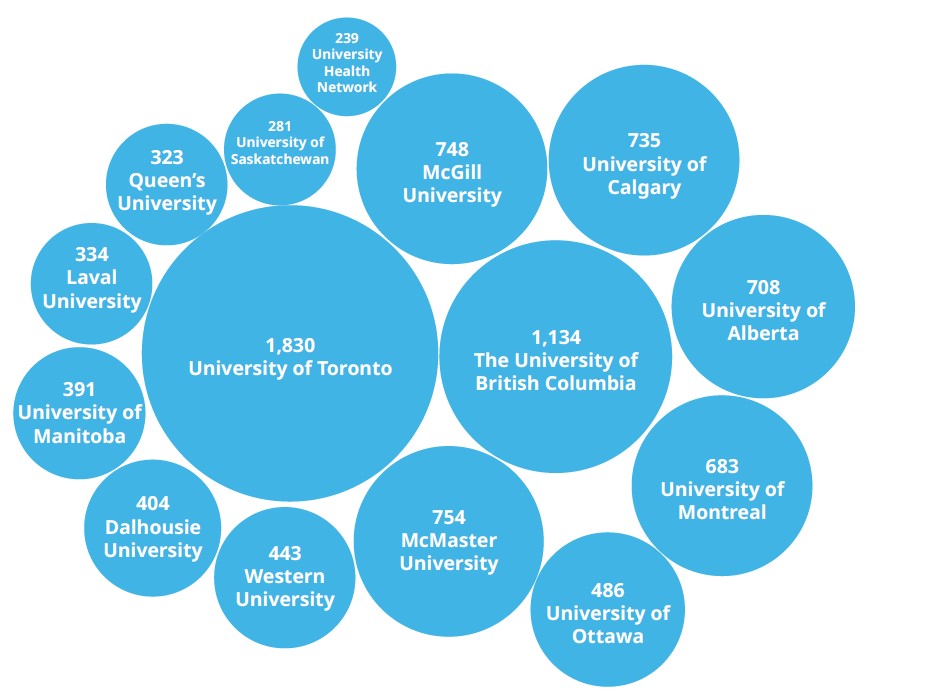

Institutions such as the University of Toronto (ranked 21st globally), the University of British Columbia (41st), and McGill University (45th) provide world-class research and talent pipelines. In addition, universities are the top three associated organisations for investigators of clinical trials.

Investigators by Top 15 Associated Organizations

Top 15 Associated institutions of clinical trials in Phase I-IV, Canada.

Source: GlobalData Pharma Intelligence Center

This academic strength, coupled with institutions such as the Canadian Clinical Trials

Coordinating Centre, provides robust infrastructure for conducting and coordinating studies.

The number of clinical trials in Canada ramped up significantly in 2001 when Health Canada became the regulatory authority responsible for clinical trial approvals oversight and inspections, in accordance with Canada Food and Drug Regulations. The new regulatory framework was instigated with two main objectives: to strengthen the protections for patients, and increase research and development investment in clinical trials in Canada.

The framework also includes fundamental elements of Good Clinical Practices such as ensuring sound clinical research and maintaining accurate records. A major change that this brought about was the shortening of standard review for Phase I trials in healthy volunteers to 60 days to seven days. This more favourable regulatory environment saw life sciences investors move into the Canadian market.

Economically, Canada’s pharmaceutical industry was valued at $25.55bn in 2020 and is projected to grow to $27.08bn by 2026, according to GlobalData. Regulatory changes in 2001 also streamlined processes, reducing Phase I clinical trial review times from 60 days to just seven days, while incorporating fundamental elements of Good Clinical Practice. Combined with R&D tax incentives such as the Scientific Research and Experimental Development program, Canada has built a pro-innovation environment that supports trial sponsors from start to finish.

Canada also benefits from its geographic position and advanced logistics infrastructure. With major trial hubs centres around Toronto, Montreal and Vancouver, sponsors have access to world-class airports, seaports and road networks with further investment for continuous improvement. The government has the Transportation 2030 strategic plan in place for a national transportation system that supports economic growth.

One of the themes of this federal plan is Trade Corridors to Global Markets, to optimise the flow of goods. There is also the National Trade Corridors Fund which will be funding projects until 2028 to improve the fluidity of Canada’s supply chains. As supply chains face increasing strain from geopolitical disruption, Canada’s reputation for regulatory compliance and logistical reliability positions the country as a standout choice.

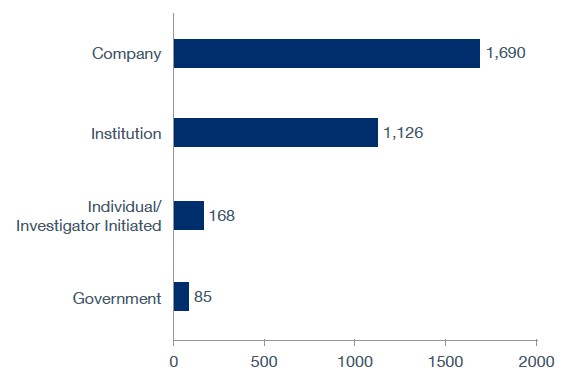

Clinical Trials in Canada – The Numbers

As of late-2024, the majority of clinical trials (1,690) were sponsored by companies, according to GlobalData. This is followed by 1,126 by institutions, 168 by individuals or investigators, and 85 by government bodies.

Sponsor Type

Top sponsor types of clinical trials in Canada as of late 2024.

Source: GlobalData Pharma Intelligence Center

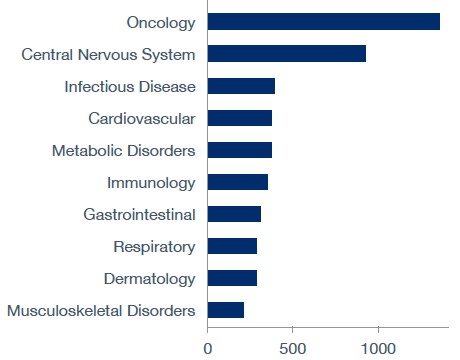

Top Therapy Areas

Top ten therapy areas of ongoing and completed trials in Canada since October 2020.

Source: GlobalData Pharma Intelligence Center

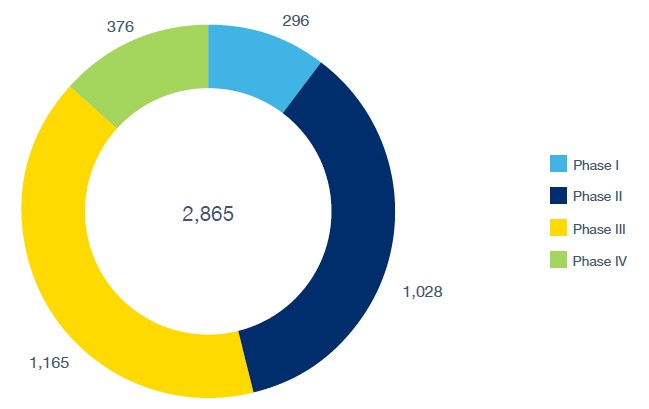

As of September 2025, GlobalData recorded Canada as having 2,865 active or ongoing trials in Phases I-IV. By phase, 296 trials were in Phase I, 1,028 in Phase II, 1,165 in Phase III, and 376 in Phase IV. These figures underscore both the scale and breadth of Canada’s role in global clinical research.

Trial Phase

Ongoing clinical trials in Canada by phase.

Source: GlobalData Pharma Intelligence Center

Supply chain challenges in clinical trials

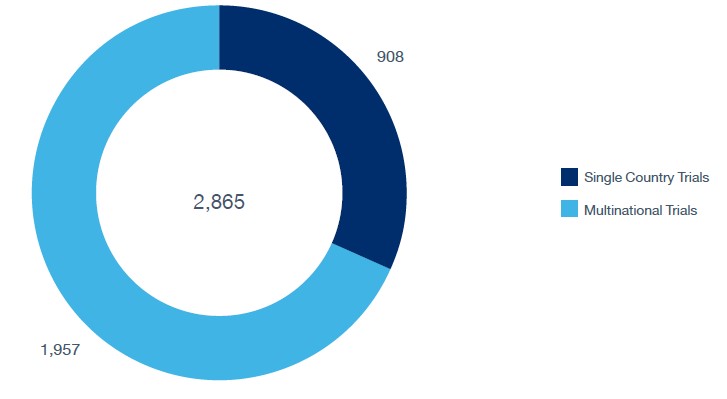

Despite these advantages, logistics remains a critical challenge. Clinical trial materials, including drugs, medical devices, and biological samples, must be transported under strict conditions, on time, and in compliance with regulations. Of the 235 planned clinical trials in Canada as of September 2024, GlobalData recorded 175 single-country studies, while 60 (25.5%) were multicountry, highlighting the increasing complexity of international operations.

Location Type

Ongoing clinical trials in Canada by phase.

Source: GlobalData Pharma Intelligence Center

Multi-country trials pose greater challenges due to varying time zones, customs regulations, and storage requirements. Effective logistics demand strict temperature control, sourcing and distribution networks, and precise storage capabilities. Delays or disruptions can directly affect patient safety and compromise trial outcomes. For this reason, sponsors increasingly depend on global logistics providers with experience in over 50 countries and the flexibility to navigate diverse infrastructures.

How 3PL can enable trial success in Canada

Third-party logistics (3PL) providers are critical enablers of trial success. Companies such as Oximio can offer these essential services. With more than 20 years of experience and operations across 50 countries, Oximio provides critical support to both large pharmaceutical firms and smaller biotech players.

Located in Hamilton, Ontario, Oximio BARL Canada offers a full suite of capabilities. The depot is located within the Greater Toronto and Hamilton Area, home to 7.2 million people. Capabilities offered include handling antibiotics, cytotoxins, dangerous goods, and ancillary supplies, as well as supporting temperature ranges from ambient (15°C to 25°C) to deep frozen (-60°C to -80°C).

Services include labelling (just-in-time), comparator sourcing, importer-of-record services, and both direct-to-patient (DTP) and direct-to-site (DTS) delivery. The depot is also certified with GDP and GMP licences. Such infrastructure ensures Canada can support the operational needs of modern trials while maintaining compliance and efficiency.

The global clinical trials industry is facing mounting pressures, from rising costs and regulatory uncertainty to supply chain challenges and geopolitical disruptions. Within this landscape, Canada is carving out a strong position. Its stable political and economic environment, universal healthcare system, diverse population, world-class academic and research networks, and pro-innovation regulatory framework make it an attractive alternative to less predictable markets.

With more than 2,800 active trials, growing pharmaceutical investment, and reliable logistics infrastructure, Canada stands to consolidate its role as a leading hub for clinical research. For sponsors, investors, and patients alike, the country represents not only a safe haven but also a strategic opportunity in a rapidly changing world.

Companies such as Oximio BARL Canada stand ready to offer the key logistics services required in clinical research.

Oximio BARL Canada

In October 2025, Oximio welcomed Bay Area Research Logistics (BARL), Canada to the Oximio family. This strategic move combines Oximio’s extensive global supply chain expertise with BARL’s considerable experience in North American and global markets and further strengthens, Oximio’s global footprint whilst enhancing its capabilities across the globe.

Find out how our tailor-made supply chain solutions can support your clinical trial in Canada and North America: https://oximio.com/network/canada/

Five Strategies to Optimise Clinical Trial Customs Tax in Europe

As the global clinical trial supply and logistics market continues to grow to support increasing pharma R&D, there is a resulting demand to drive down cost in the supply chain.

The VAT and customs implications of clinical trials are commonly overlooked, as the focus is largely on product sourcing requirements, temperature control, local regulatory requirements and decentralized trial setup. Taking a tactical approach can significantly reduce VAT and customs challenges, making the budget stretch further. This article addresses key considerations for VAT across Europe in the supply chain, in addition to five key cost optimisation takeaways.

How VAT and duties appear in the budgets of clinical trials

It is essential to factor in VAT and customs implications when managing clinical trials. Based on our recent survey, CMOs, CROs and Sponsors do not tend to budget for country-specific customs payments. Only a few respondents confirmed that they have relevant budget lines in their clinical demand planning models. Most of the companies treat Customs VAT and Duties as pass-through costs and consider them as inevitable expenses.

What is claimable/non-reclaimable per country?

Customs VAT can usually be reclaimed in the EU and the UK (if a relevant EORI number is used for clearance). EU residents can reclaim via the ‘EU VAT Refund’ and through the ‘13th Directive Claim’. Importantly, only sponsors owning the product are eligible for the reclaim procedure (IoRs and CROs cannot officially apply for the reclaim). In non-EU (EAMA) countries, Customs VAT is normally absorbed into a cost and cannot officially be reclaimed. The sponsor companies may include these local costs in their investment VAT and offset it via the tax balance. Even though VAT may not be officially reclaimed, some countries provide full exemption to VAT related to the importation of Investigational Medicinal Products, like Malta.

How reclamation works

We can divide European countries into three main groups:

1 – Countries with High Tax Regime (15-25%): Bulgaria, Croatia, Denmark, Germany, Lithuania, Slovakia, Slovenia, Moldova, United Kingdom

2 – Countries with Moderate Tax Regime (7-15%): Austria, Czech Republic, Estonia, France, Finland, Italy, Latvia, Turkey, Serbia, Bosnia & Hercegovina, North Macedonia

3 – Countries with Simpli ied Tax Regime (less than 7%): Cyprus, Greece, Georgia, Hungary, Ireland, Luxemburg, Malta, Portugal, Spain, Sweden, Ukraine, Israel

Bottlenecks, and how to resolve them

If customs payments are not budgeted and planned for properly, they can be an extreme burden on the sponsor’s cash flow at the time of site initiation and for large bulk shipments. A review of the country’s requirements can lead to potential changes in its selection and supply chain.

1 – Choice of port of entry

You can influence the rate that applies by carefully assessing the port of entry. For example, if 19% is applied in Germany vs 5% in Hungary, that already delivers 14% economic value.

2 – On-demand supply

The strategy includes the setup of multiple packaging providers being able to act as regional distribution hubs. The distribution sites can drive efficiency via using bonded depots as well as pooling some IMP from various protocols and at the same time having expedited timelines and being closer to the demand. Some countries provide advantages for doing packaging and labelling in their countries – and Spain is one of the examples – they may provide tax advantages once the imported products are not considered as finished forms.

3 – Value adjustment

This approach is based on adjusting the value of IMP to a lower rate if legally possible in the country of destination. For example, lowering the cost of the comparator to the registered price in the country of a destination rather than the cost of sourcing (which can be higher). Another good option is to apply the nominal value of the product. For example, have an unblinded depot where placebo is shipped at its nominal value.

4 – Late-stage correction

If the cost of the production (manufacturing and labeling) reduces from phase 1 to phase 3, the value of IMP can be corrected accordingly. If unused IMP is used in another trial, it can influence the sums paid at customs.

5 – Cost reduction case study

Managing VAT correctly – legally but wisely – can bring an advantage. Here is an example of the actual email to customs from an Oximio sponsor client. They implemented our optimisation strategies, resulting in a significant cost reduction for their R&D department.

Summary

Rapid growth in the clinical trial supply and logistics market has highlighted customs and tax complexities for VAT across Europe in the supply chain. It is essential that CMOs, CROs and Sponsors consider customs and VAT implications when transporting patient medications to cross-border sites. With the correct planning using the five key strategies outlined above, unnecessary spending can be mitigated.

Download the whitepaper (pdf): Five strategies to optimise clinical trial customs tax in Europe

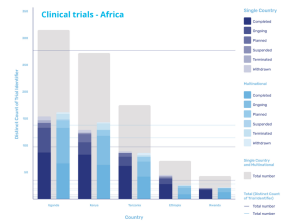

Unlocking the Clinical Trial Potential of Africa

Africa is facing a pivotal moment in its role in clinical trial history. With ongoing improvements around infrastructure, continued investment, as well as being home to one of the world’s largest working age populations, the region is finally being recognised as a key contender in the clinical trials market. But for sponsors, challenges and hesitancy remain.

This paper will examine the dynamics of today’s clinical trial market in Africa, taking a closer look at the key challenges the region is facing including the differing regulatory requirements from country to country, as well as supply chain burdens and how sponsors can overcome them to unlock the continent’s growing potential.

Turning attention to the African continent

Considering that it accounts for one-fifth of the globe’s total land area and has a population that is larger than that of Europe and North America combined, the African continent seems hard to overlook, particularly as its working age population will be the largest globally by 2050.

Bearing the largest disease burden in the world, with an estimated 25% of all infections occurring within the continent, it would appear even more unlikely for it to receive limited attention when it comes to the development and trialling of new drugs and therapeutics to prevent and treat disease.

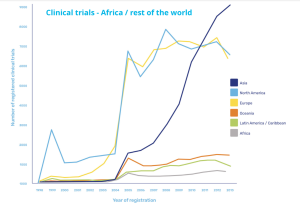

However, while there is focus on diseases concentrated within its borders and more prominently than in other continents, the proportion of clinical trials as a whole conducted in Africa appears grossly insufficient.

Clinical trials in Africa vs rest of the world

Increased activities driven by Covid-19

Covid-19 has prompted an increase in activity, with a paper published in The Lancet in May 2021 reporting unprecedented global efforts in research and development. But of the more than 3,000 trials of interventions for COVID-19 that were underway at that time, only 145 were taking place in Africa, clearly highlighting that an imbalance remains.

At the same time, the pandemic has also exemplified just how critical it is that the drug development process, and in particular the clinical trials that make or break them, draw on a diverse genetic pool order to account for different disease presentation in different ethnicities.

Dr Bernhards Ogutu, chief research officer at the Kenya Medical Research Institute, explains that to date, the bulk of trial activity in Africa, “has been much more focused on the infectious diseases which are more common such as HIV, malaria and tuberculosis, and that have been picked up as major public health problems.”

And while he welcomes the fact that activities have increased in response to Covid-19, he has observed that even in this area, trials have tended to be later-stage, with the early trials and drug development stages being carried out in more traditionally mature markets.

However, he is hopeful that there are early signs of this starting to change. “There are countries that have the developed infrastructure for early phase trials,” he explains. “There might be a concerted effort on building this capacity and making sure that most of the diseases start getting the African genome into the product development.”

Improving infrastructure and overcoming challenges

Low levels of activity within the scope of medical trials, and particularly early-stage trials, can be attributed to uncertainty around the required infrastructure – either that it’s not present, or not up to the same standards as found in Europe, the US, or Asia.

This includes issues with general infrastructure, like the condition of roads preventing quick transportation and distribution, but also with specialized study requirements, like sufficient Contract Research Organisations (CROs) in place to carry out the trials.

But while it is true that the capabilities of countries across Africa differ to a significant degree, there are many that have matured in recent years. These countries offer services comparable to those in established regions, which in turn offer the opportunity to expand into those with less developed resources.

This has been driven through the strength of the economy and trading relationships, in the case of South Africa or through the use of existing infrastructure and supply chains that have been established by NGOs and public-private-partnerships to carry out trials and provide treatment across the harder to reach areas of the continent through bodies such as the Drugs for Neglected Diseases Initiative.

The new gateway of East Africa

The state of clinical trials in Africa

East Africa is developing rapidly, with Kenya often serving as a central hub, leading capability and capacity development of other countries in the region.

According to research from GlobalData, the majority of the trials in the region are being carried out in Uganda, which accounts for 154 single country trials and 161 multinational trials, and Kenya itself, where 129 single county trials and 143 multinational trials are being carried out. However, activity in the region is also increasing in Tanzania, Ethiopia, and Rwanda as the region continues to mature its infrastructure and local supply chains.

Dr Ogutu, who has played a key role in delivering single and multi-country trials, has witnessed first-hand what is possible, explaining that as part of the Malarial Clinical Trials Initiative, he worked on a trial that was carried out across 21 sites in 10 different countries across the continent. This required significant investment and resources to get up and running initially, but as a result has prepared them to expand into more flexible supply chains.

“They have been putting resources to network and build new capacity in terms of human resource, and physical infrastructure around the clinical trials as they are carried out,” he says. “They have certain sites already, and these sites are the ones they will diversify for trials but use the same infrastructure.”

Easing the regulatory burden

As these networks develop and intra-African supply chains for clinical trials mature, the opportunities to expand the scope of trials will increase. However, for the potential to be fully realised, sponsors and developers will likely require support in overcoming the regulatory frameworks that have historically been perceived as significant barriers.

Jacob Odika Apollo, consultant at Oximio, has monitored the completion of more than 20 clinical trials in Africa, and he appreciates that the different regulatory frameworks in a continent made up of more than 40 different countries can appear daunting.

“These are different countries with different regulatory requirements,” says Apollo. “So even if you are conducting a multinational trial, each country has its own regulatory requirements which may differ from the other.”

However, while these barriers may have proven almost insurmountable in the past, a combination of key local knowledge and close collaboration with the relevant authorities has enabled trial partners to overcome regulatory challenges. According to Apollo: “In terms of the development of regulatory practice, Oximio has a robust and well-developed framework for clinical trials.”

Key to managing this regulatory complexity is a combination of what approvals are required and how long it takes to receive approval. In the case of Kenya, parties are required to submit Proforma Invoices (PFIs) and Certificates of Origin (COAs) which take 14 to 28 days to be granted. Whereas in Ghana, while approval only takes 8 to 10 days, additional permit fees and a Valid License of Importer must also be submitted.

Clinical Trial Services in Africa: Partnering for success and rapid deployment

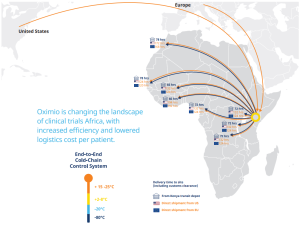

Oximio – changing the landscape of clinical trials in Africa

A key element to expediting both the approvals process and the delivery of supplies is in partnering with the right partners.

“Shipping direct from USA and Europe into the region, we can reduce the average timeline by 50%, explains Rob Van Den Bergh, managing director at Oximio, who adds that due to having its own depot in Kenya, it can distribute supplies quickly to other countries in the continent at short notice. “In Kenya, we can do a rapid deployment of a clinical trial material a lot faster than you can from Europe and USA as well.”

In addition to speeding up distribution processes across Africa, an established, local network between trial partners and the target region will enable significant cost and administration savings to be delivered through the clinical trials process. “This will be an immense saving in time and money to the sponsors,” says Van Den Bergh. “We’re hoping to roll that out to other neighbouring countries as well, so that they will see the benefit there too, and using Kenya as the new gateway into Africa.”

Capitalising on cost savings while reaping the benefits of comparable service

Arrangements such as this are part of wider efforts by clinical trial partners to demonstrate that by enabling regulatory frameworks to operate in a fashion that streamlines the administrative burden and minimises delays on conducting clinical trials delivers benefits for all.

But at the same time as the African supply chains develop to align with those in more established markets, some of the emerging practices in Africa are also starting to gain wider acceptance elsewhere, and by those potentially attracted to carrying out trials in Africa.

One example is the use of remote monitoring in clinical trials. While this has been encouraged in markets such as the US since the early 2000s, it’s adoption more broadly has only recently started to happen as a result of the difficulties created by Covid and the rapid need to conduct large-scale trials.

“Even when you include patient care as one of the benefits of participating in the trials, the petition cost is still much lower than similar studies being conducted in Europe or other markets.”

But Africa is several years ahead of the curve in terms of remote trial adoption, due to a combination of high mobile phone usage, how widely disbursed the population is and, in particular, because of the use of remote trials conducted during the Ebola crisis in 2014. As a result, Africa is well placed to benefit as such approaches continue to grow in prominence.

Ultimately though, the main incentive to those considering carrying out or increasing their activities within Africa is that it is both easier and comparatively cheaper to recruit a broad section of trial participants.

This ease of recruitment is largely driven by the fact that the cost of participants’ medical care is commonly paid for by those running the sites. This has been a cause for concern for potential sponsors, who believe it will lead to cost increases for trials.

However, as Dr Oguto, explains, the comparative cost is still lower even when this is accounted for: “From my experience on site, even when you include patient care as one of the benefits of participating in the trials, the participation cost is still much lower than similar studies being conducted in Europe or other markets.”

As these lower costs are increasingly complemented by stronger infrastructure and faster supply chains, the incentive to capitalise on the potential benefits – both financially and medically – of giving Africa the attention it deserves will gradually evolve into an imperative.

Download the full whitepaper: Unlocking the clinical trial potential of Africa.

Explore Oximio’s clinical trial services in Africa.

IOR: Overcoming Challenges with International Clinical Supplies

In the clinical supply chain, the Importer of Record (IoR) plays a crucial role in managing the logistics and regulatory complexities of importing sensitive biopharma products and bio samples. With international regulations varying by country, IoRs ensure smooth operations by handling documentation, customs clearance, and compliance, allowing sponsors and CROs to focus on their core responsibilities. As global clinical trials become more prevalent, the importance of selecting a knowledgeable IoR partner grows, ensuring that trials proceed without costly delays or compliance issues.

In our latest article and accompanying whitepaper, we explore “Importer of Record: Overcoming challenges with international clinical supplies” . Download today.